UK HMRC CA3916 2012 free printable template

Show details

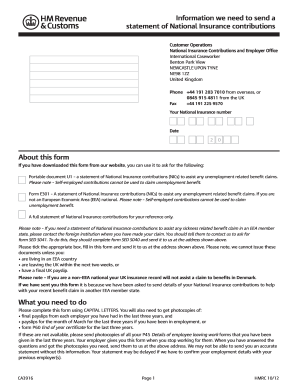

Information we need to send a statement of National Insurance contributions Customer Operations National Insurance Contributions and Employer Office International Caseworker Benton Park View NEWCASTLE

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign UK HMRC CA3916

Edit your UK HMRC CA3916 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your UK HMRC CA3916 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit UK HMRC CA3916 online

Follow the steps below to benefit from the PDF editor's expertise:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit UK HMRC CA3916. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

pdfFiller makes working with documents easier than you could ever imagine. Try it for yourself by creating an account!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

UK HMRC CA3916 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out UK HMRC CA3916

How to fill out UK HMRC CA3916

01

Obtain the CA3916 form from the HMRC website or through local HMRC offices.

02

Fill in your personal details, including your name, address, and National Insurance number.

03

Provide details of the assets held outside the UK, including bank accounts, property, and investments.

04

State the country where these assets are held.

05

Include the value of each asset in GBP as of the relevant date.

06

Sign and date the form to confirm that the information is accurate to the best of your knowledge.

07

Submit the completed form to HMRC by the specified deadline.

Who needs UK HMRC CA3916?

01

UK residents who have assets located outside the UK that are valued over a certain threshold need to complete the CA3916 form.

02

This form is required for individuals who need to declare foreign income or capital gains to HMRC.

Fill

form

: Try Risk Free

People Also Ask about

How to tell HMRC you no longer need to complete a tax return UK?

If you think you do not need to submit a tax return, for example because all your income is taxed under PAYE and you have no additional tax liability, you can phone HMRC on 0300 200 3310 and ask for the tax return to be withdrawn. If HMRC agrees, this will means that you no longer have to file a return.

How many years do you need for a full state pension?

You'll need 35 qualifying years to get the full new State Pension. You'll get a proportion of the new State Pension if you have between 10 and 35 qualifying years.

What to do when returning to UK after living abroad?

Income Establishing a credit rating as soon as possible if you have not retained a UK bank account, credit cards or a mortgage. Registering your return to the UK with HMRC. Checking whether you need to make up any missing years for National Insurance. Enrolling for self-assessment.

Do I need to inform HMRC when I return to the UK?

Contact HMRC if your circumstances change when you are abroad - you move house or your marital status changes, for example. You will need your National Insurance number. You also need to tell HMRC if you come back to live in the UK .

What is a P85 form for leaving the UK?

What is a P85 form? A P85 is the form you complete to officially tell HMRC that you are leaving the UK. You must provide answers to a number of questions concerning you and your tax affairs. The P85 form helps HMRC update your tax record with your correct UK residence status for tax purposes.

Can I get National Insurance back when leaving UK?

You cannot claim back any National Insurance you've paid in the UK if you leave the UK permanently. However, anything you've paid might count towards benefits in the country you're moving to - if it's one of the countries that have a social security agreement with the UK.

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit UK HMRC CA3916 online?

With pdfFiller, you may not only alter the content but also rearrange the pages. Upload your UK HMRC CA3916 and modify it with a few clicks. The editor lets you add photos, sticky notes, text boxes, and more to PDFs.

How do I make edits in UK HMRC CA3916 without leaving Chrome?

Get and add pdfFiller Google Chrome Extension to your browser to edit, fill out and eSign your UK HMRC CA3916, which you can open in the editor directly from a Google search page in just one click. Execute your fillable documents from any internet-connected device without leaving Chrome.

How do I edit UK HMRC CA3916 on an iOS device?

Yes, you can. With the pdfFiller mobile app, you can instantly edit, share, and sign UK HMRC CA3916 on your iOS device. Get it at the Apple Store and install it in seconds. The application is free, but you will have to create an account to purchase a subscription or activate a free trial.

What is UK HMRC CA3916?

UK HMRC CA3916 is a form used by individuals and entities to report certain types of income, specifically relating to foreign income and gains.

Who is required to file UK HMRC CA3916?

Individuals or entities with foreign income or gains that need to be reported to HMRC are required to file the CA3916 form.

How to fill out UK HMRC CA3916?

To fill out the CA3916 form, you should provide your personal details, including your name, address, and taxpayer identification, alongside detailed information about your foreign income or gains.

What is the purpose of UK HMRC CA3916?

The purpose of the CA3916 form is to ensure that HMRC receives accurate information about foreign income and gains to assess tax liabilities appropriately.

What information must be reported on UK HMRC CA3916?

The information that must be reported includes details of foreign income, gains, the country of origin, and any applicable exemptions or allowances.

Fill out your UK HMRC CA3916 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

UK HMRC ca3916 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.