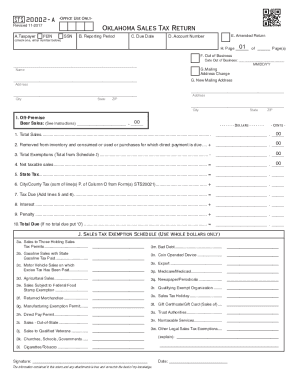

Get the free oklahoma sales tax

Get, Create, Make and Sign oklahoma sales tax form

How to edit oklahoma sales tax return form online

How to fill out sts 20003 a revised 06 2017 form

How to fill out Oklahoma sales tax return:

Who needs Oklahoma sales tax return:

Video instructions and help with filling out and completing oklahoma sales tax

Instructions and Help about oklahoma sales tax return worksheet sts 20003 a

Today we are going to learn how to file that riddance to file the word return first we have to download new head written form that is from Mohammed dot gob not before filing the VAT return first you check the updates that the facility to upload he has written for the month of April 2016 will be made available shortly, but we are going to learn basic information how to file the VAT return you can download this from forms from bots new cells purchase on Excel basics to 2007 click on this form is downloaded open this form I am putting it left form folder that is wrong now open cells purchase a lecture this is new cell tax return form or weds written form here you have to write wet RC number that is 11 digits ended by B or C Q seven eight two zero three eight two three five six V you can copy and paste over here copy and paste is allowed in new form name of the dealer return type you have to select return type original if it is revised you have to select BY's form type 231 232 233 here you can see that you can file to 31 to 34 in one return — 31 t3—

People Also Ask about ok form sts20003 a

What is the formula for calculating sales tax?

How to file sales tax return in Oklahoma?

How do you figure out sales tax in Oklahoma?

How do I report sales on my tax return?

How do I calculate sales tax in Oklahoma?

Is a sales tax permit the same as a resale certificate in Oklahoma?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get sts 20003?

How do I edit sts 20003 a online?

Can I sign the oklahoma sales tax form sts 20003 a electronically in Chrome?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.