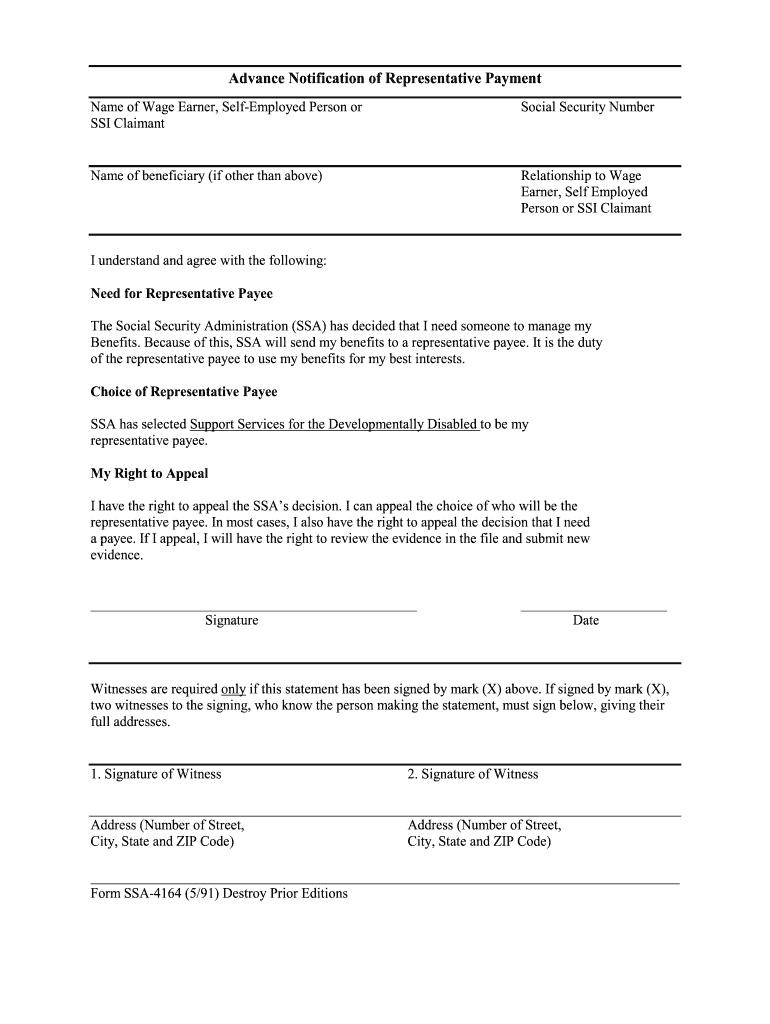

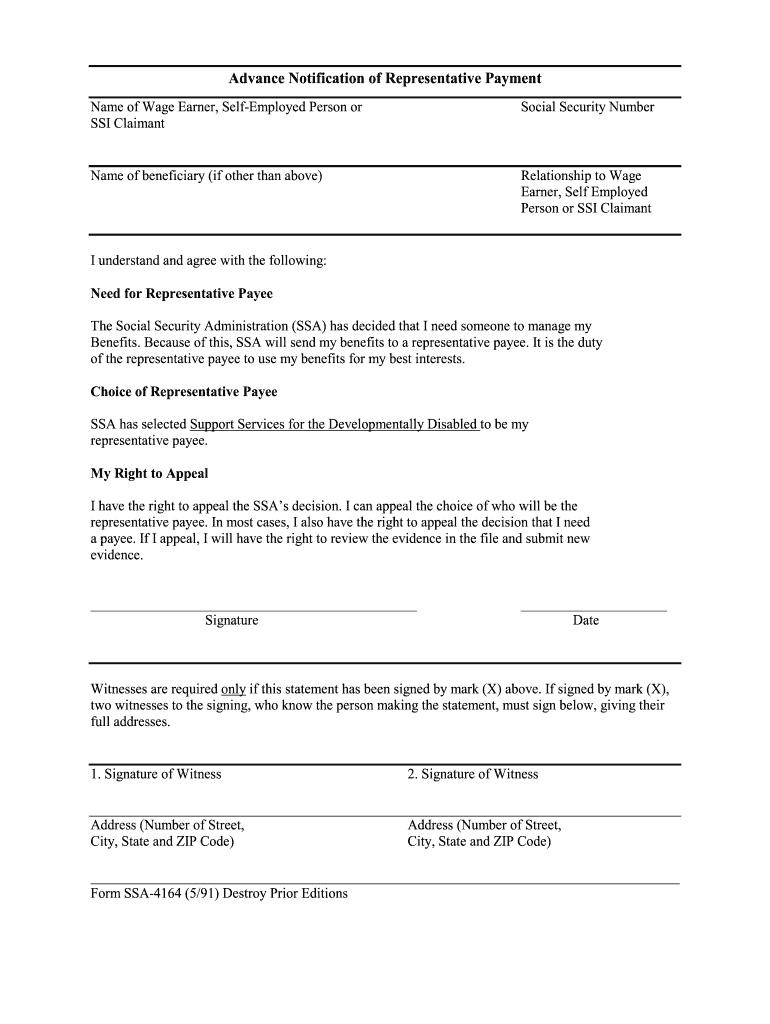

SSA-4164 1991 free printable template

Show details

The Social Security Administration (SSA) has decided that I need someone to manage ... City, State and ZIP Code) ... Form SSA-4164 (5/91) Destroy Prior Editions.

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign SSA-4164

Edit your SSA-4164 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your SSA-4164 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit SSA-4164 online

To use the services of a skilled PDF editor, follow these steps:

1

Log in to your account. Click Start Free Trial and register a profile if you don't have one yet.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit SSA-4164. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

SSA-4164 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out SSA-4164

How to fill out SSA-4164

01

Begin by obtaining the SSA-4164 form from the Social Security Administration's website or local office.

02

Fill in your personal information at the top of the form, including your name, address, and Social Security number.

03

Read the instructions carefully to understand the type of information required.

04

Complete each section of the form as instructed, providing detailed and accurate information.

05

If applicable, provide any necessary supporting documentation needed to accompany the SSA-4164.

06

Review the completed form for accuracy and completeness.

07

Sign and date the form where required.

08

Submit the form as directed by the instructions, either electronically or via mail.

Who needs SSA-4164?

01

Individuals who have been requested to provide information regarding their work history or earnings for a Social Security claim.

02

People applying for Social Security benefits who need to verify their past work details.

03

Any claimant or beneficiary of Social Security who has been instructed to fill out the SSA-4164 form.

Fill

form

: Try Risk Free

People Also Ask about

Who is the claimant on form SSA 11?

Name of the person(s) for whom you are filing (claimant) Claimant's social security number. Indication if you are the claimant and what your benefits paid directly to you. Explanation if you think the claimant is not able to handle his or her own benefits.

What is a SSA 4164 form?

The SSA-4164 provides the beneficiary (or legal guardian/representative who can act for the beneficiary) with advance notification of Form SSA-1696 | Appointment of Representative - Social

How do I get an SSA 11 form?

If you can't find the form you need, or you need help completing a form, please call us at 1-800-772-1213 (TTY 1-800-325-0778) or contact your local Social Security office and we will help you.

What is an advance notification of representative payee?

To help protect what is important to you, we offer the option to advance designate a representative payee. Advance designation allows you to designate up to three individuals who could serve as a representative payee for you if the need ever arises.

What is the SSA 11 application for representative payee?

A Form SSA 11-BK is known as a Request to be Selected as Payee. It will be used by someone who wants to become a representative payee for another payee. This form must be completed in a face-to-face interview with someone from the Social Security Administration in order to determine eligibility and suitability.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is ssa advance notification of?

SSA advance notification typically refers to a communication or letter sent by the Social Security Administration (SSA) to inform individuals about upcoming changes, updates, or actions related to their Social Security benefits or status. These notifications can cover various topics such as changes in benefit amounts, eligibility criteria, reporting requirements, healthcare coverage, or any other important information related to Social Security programs. The purpose of these notifications is to keep individuals informed and provide advance notice about any potential impacts on their benefits or necessary actions they might need to take.

Who is required to file ssa advance notification of?

The SSA (Social Security Administration) Advance Notification is required to be filed by all employers who are planning to downsize or lay off a large number of employees. This is done to ensure that the affected individuals are aware of their rights and options under the Social Security Act.

How to fill out ssa advance notification of?

To fill out the SSA Advance Notification of Representation form, you can follow these steps:

1. Visit the Social Security Administration's website or go to your local Social Security office and request the form SSA-1696, Advance Notification of Representation.

2. Read the instructions on the form carefully. Make sure you understand the purpose of the form and how to correctly fill it out.

3. Provide your personal information on the top section of the form. This includes your name, address, phone number, and your relationship with the claimant (if you are not the claimant).

4. Fill in the name and Social Security number of the claimant in the designated fields.

5. Indicate the claimant's type of claim (retirement, disability, survivor, or Medicare) by checking the appropriate box.

6. Specify the type of representation you are providing. You can choose from attorney, non-attorney representative, or organization. Mark the relevant box.

7. If you are an attorney or non-attorney representative, provide your name, address, phone number, and your attorney or representative bar number (if applicable).

8. Fill in the contact information for the person or agency you are notifying as the claimant's representative. Include their name, address, phone number, and email (if available).

9. Check the box that pertains to whether you are filing a fee agreement on the claimant's behalf.

10. Sign and date the form at the bottom.

11. Make a copy of the completed form for your records.

12. Submit the form to the Social Security Administration by mail or in person at your local office. Keep a copy of the receipt or any confirmation you receive for your records, as proof of submission.

Remember, if you are unsure about how to fill out the form correctly or have any questions, it is recommended to seek guidance from a legal professional or contact the Social Security Administration directly for assistance.

What is the purpose of ssa advance notification of?

The purpose of SSA (Social Security Administration) advance notification is to inform individuals about important changes or updates that may affect their Social Security benefits or services. This notification ensures that individuals have an opportunity to prepare or take necessary action based on the upcoming changes. It allows recipients to be aware of any adjustments in their benefits, changes in program rules, policy updates, payment schedules, or any other relevant information related to Social Security programs.

What information must be reported on ssa advance notification of?

The SSA (Social Security Administration) Advance Notification of Information is required to be reported for the following information:

1. Changes in employment or earnings: If the recipient of Social Security benefits starts or stops working, changes employers, or experiences an increase or decrease in wages, it must be reported.

2. Change in marital status: Any change in marital status, such as getting married or divorced, must be reported.

3. Changes in living arrangements: If the recipient moves, changes their address, or starts living with someone else, it must be reported.

4. Changes in disability or medical condition: If there are any changes in the recipient's disability or medical condition, including improvement or worsening of the condition, it must be reported.

5. Change in eligibility factors: If there are any changes in the eligibility factors for Social Security benefits, such as income or resources, it must be reported.

6. Changes in other benefits: If the recipient starts or stops receiving other benefits, such as workers' compensation or pension, it must be reported.

7. Changes in representative payee: If the recipient appoints or changes a representative payee who handles their benefits, it must be reported.

8. Incarceration: If the recipient is incarcerated or released from incarceration, it must be reported.

It is important to note that these reporting requirements may vary depending on the specific benefits program and individual circumstances. It is recommended to contact the Social Security Administration or visit their official website for the most accurate and up-to-date information.

How can I manage my SSA-4164 directly from Gmail?

You may use pdfFiller's Gmail add-on to change, fill out, and eSign your SSA-4164 as well as other documents directly in your inbox by using the pdfFiller add-on for Gmail. pdfFiller for Gmail may be found on the Google Workspace Marketplace. Use the time you would have spent dealing with your papers and eSignatures for more vital tasks instead.

Can I edit SSA-4164 on an iOS device?

Yes, you can. With the pdfFiller mobile app, you can instantly edit, share, and sign SSA-4164 on your iOS device. Get it at the Apple Store and install it in seconds. The application is free, but you will have to create an account to purchase a subscription or activate a free trial.

How do I edit SSA-4164 on an Android device?

The pdfFiller app for Android allows you to edit PDF files like SSA-4164. Mobile document editing, signing, and sending. Install the app to ease document management anywhere.

What is SSA-4164?

SSA-4164 is a form used by the Social Security Administration (SSA) to collect information regarding a specific individual's earnings and work history.

Who is required to file SSA-4164?

Individuals who are applying for Social Security benefits and need to report their work history and earnings to the SSA are required to file SSA-4164.

How to fill out SSA-4164?

To fill out SSA-4164, individuals should provide accurate information regarding their employment history, including names of employers, dates of employment, and earnings. It is important to follow the instructions provided on the form carefully.

What is the purpose of SSA-4164?

The purpose of SSA-4164 is to gather necessary information about an individual's work history and earnings to help determine their eligibility for Social Security benefits.

What information must be reported on SSA-4164?

SSA-4164 requires individuals to report their full name, Social Security number, employment details, earnings from each employer, and any other relevant information requested on the form.

Fill out your SSA-4164 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

SSA-4164 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.