Get the free pdffiller

Show details

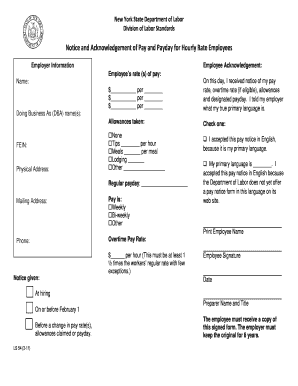

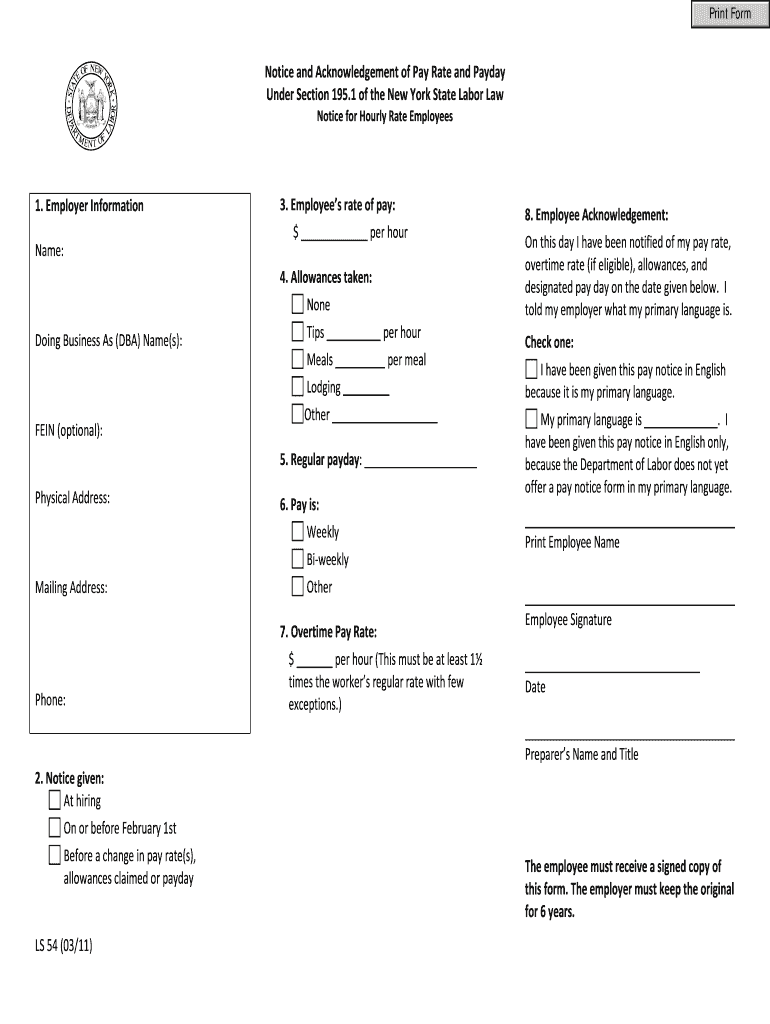

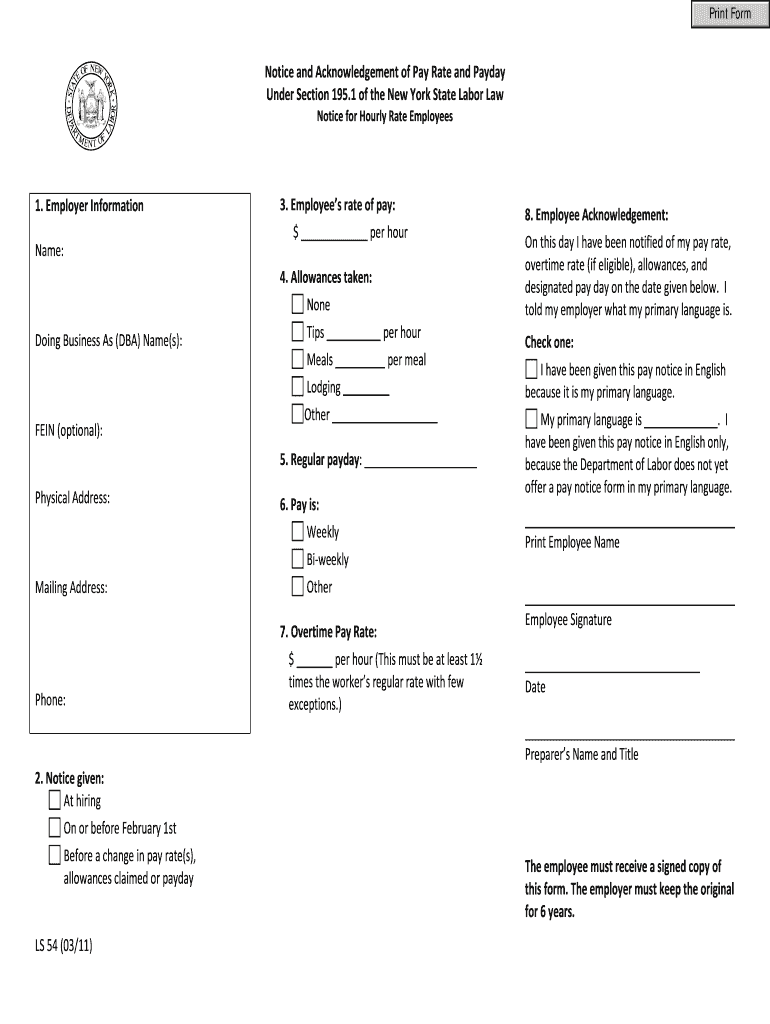

Print Form Notice and Acknowledgement of Pay Rate and Payday Under Section 195. 1 of the New York State Labor Law Notice for Hourly Rate Employees 1.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign ls 54 form

Edit your ls54 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your nys ls 54 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit pdffiller form online

Use the instructions below to start using our professional PDF editor:

1

Check your account. It's time to start your free trial.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit pdffiller form. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

With pdfFiller, it's always easy to deal with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out pdffiller form

How to fill out ls 54 form:

01

Begin by obtaining a copy of the ls 54 form. This can typically be done by visiting the official website of the organization or agency that requires the form to be filled out.

02

Carefully read the instructions provided with the form. Make sure to understand all the requirements and any specific details that need to be included.

03

Gather all the necessary information and documentation that will be needed to complete the form. This may include personal details, identification documents, financial records, or any other relevant information.

04

Start filling out the form by entering your personal details in the designated fields. This may include your full name, address, contact information, date of birth, and social security number.

05

Follow the provided guidelines to complete any additional sections or questions on the form. This may involve providing information about your employment status, income, assets, or any other relevant details.

06

Double-check all the information you have entered before submitting the form. Make sure there are no errors or missing information that could cause delays or complications.

07

Sign and date the completed form in the appropriate section. Some forms may require additional signatures from witnesses or other individuals, so make sure to follow any specific instructions provided.

08

Make copies of the completed form for your records before submitting it to the relevant authority. This will ensure you have a copy of the form for future reference or if any issues arise.

Who needs ls 54 form:

01

Individuals or organizations that are required to report certain financial or personal information may need to fill out the ls 54 form. This could include employees, contractors, taxpayers, or any other individuals who are required to disclose specific details.

02

The ls 54 form may also be needed by government agencies, financial institutions, or other entities that require this information to comply with legal or regulatory requirements.

03

The specific individuals or organizations that need the ls 54 form may vary depending on the specific laws, regulations, or policies that apply in a particular jurisdiction or industry. It is important to consult the relevant authorities or seek legal advice to determine if the ls 54 form is required in a specific situation.

Fill

form

: Try Risk Free

People Also Ask about

What is required on a pay stub in New York?

Name of the employer. Employer's address and phone number. Employee's rate or rates of pay and basis thereof (by hour, shift, day, week, salary, piece, commission, or other) Gross wages earned.

What is 195.1 of the New York State Labor law?

New York Labor Law Section 195.1 requires employers to obtain signed acknowledgements of receipt from newly hired New York employees that those employees have received written notice of their pay rate and pay day and if applicable, their overtime rate, before commencing work.

What is the NY wage Act?

The Minimum Wage Act (Article 19 of the New York State Labor Law) requires that all employees in New York State receive at least $14.20 an hour beginning December 31, 2022. Minimum wage rates differ based on industry and region. Rates will increase each year until they reach $15.00 per hour.

What is the wage theft Prevention Act NY State?

The New York Wage Theft Prevention Act was passed in 2011 and is designed to protect employees from wage theft. The law ensures that employers provide written wage notices and pay stubs or risk penalties of up to $20,000 per infraction (New York Department of Labor).

What is Section 195 of NY Labor Law?

No employer shall make any charge against wages, or require an employee to make any payment by separate transaction unless such charge or payment is permitted as a deduction from wages under this Part or is permitted or required under any provision of a current collective bargaining agreement. § 195-2.2 Company stores.

What is required in a New York State wage theft Prevention Act notice?

The Wage Theft Prevention Act (WTPA) took effect on April 9, 2011. The law requires employers to give written notice of wage rates to each new hire. The notice must include: Rate or rates of pay, including overtime rate of pay (if it applies)

What is under section 195.1 of the NYS Labor Law?

New York Labor Law Section 195.1 requires employers to obtain signed acknowledgements of receipt from newly hired New York employees that those employees have received written notice of their pay rate and pay day and if applicable, their overtime rate, before commencing work.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I create an eSignature for the pdffiller form in Gmail?

You may quickly make your eSignature using pdfFiller and then eSign your pdffiller form right from your mailbox using pdfFiller's Gmail add-on. Please keep in mind that in order to preserve your signatures and signed papers, you must first create an account.

How do I fill out the pdffiller form form on my smartphone?

Use the pdfFiller mobile app to fill out and sign pdffiller form. Visit our website (https://edit-pdf-ios-android.pdffiller.com/) to learn more about our mobile applications, their features, and how to get started.

How do I edit pdffiller form on an iOS device?

Create, edit, and share pdffiller form from your iOS smartphone with the pdfFiller mobile app. Installing it from the Apple Store takes only a few seconds. You may take advantage of a free trial and select a subscription that meets your needs.

What is ls 54?

LS 54 is a form used for reporting certain information regarding labor and employment in the context of government contracts.

Who is required to file ls 54?

Employers who have government contracts and are subject to the reporting requirements related to labor conditions are required to file LS 54.

How to fill out ls 54?

To fill out LS 54, follow the provided instructions on the form, ensuring all required sections are complete with accurate and up-to-date information.

What is the purpose of ls 54?

The purpose of LS 54 is to ensure compliance with labor laws and to provide transparency regarding employment practices within government contracts.

What information must be reported on ls 54?

LS 54 requires reporting of information such as employee details, wage rates, hours worked, and any other relevant employment conditions.

Fill out your pdffiller form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Pdffiller Form is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.