Get the free teacher pay stub example

Show details

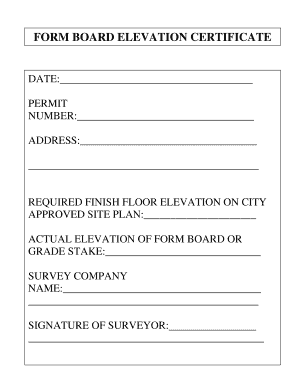

See reverse for how to match a pay stub with the Negotiated Agreement's salary schedule. Below is a sample pay stub for a teacher who: o teaches full-time and ...

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign shopify site pdffiller com site blog pdffiller com form

Edit your teacher pay stub form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your wix site pdffiller com site blog pdffiller com form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit teacher pay stub example online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit teacher pay stub example. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

Dealing with documents is always simple with pdfFiller.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out teacher pay stub example

How to Fill Out Examples Pay Stubs:

01

Obtain a blank pay stub template or download a pay stub form from a reputable source. This will serve as the basis for filling out your pay stub.

02

Begin by entering your personal information such as your full name, address, and contact details. Make sure to double-check the accuracy of this information before moving on.

03

Identify the pay period and the corresponding dates. This should reflect the time frame for which the pay stub is being generated.

04

Indicate your employer's information, including the company name, address, and contact details. This is crucial for ensuring that the pay stub is associated with the correct employer.

05

Enter your employee identification or social security number. This is necessary for identification and record-keeping purposes.

06

Input your earnings for the pay period. This includes your regular hourly or salary rate, the number of hours worked, and any overtime or bonuses earned during that period. Calculate the total pay amount accordingly.

07

Deduct any applicable taxes, such as federal, state, and local taxes. Take into account other deductions, such as social security contributions or health insurance premiums. Subtract these deductions from your total pay to arrive at your net pay.

08

Include any additional information required by your employer, such as specific codes or categories for earnings or deductions. This may vary depending on the nature of your employment or any unique circumstances.

09

Review the completed pay stub for accuracy and completeness. Ensure that all figures and information are correct before finalizing the document.

10

Make a copy of the pay stub for your records and submit the original to your employer according to their preferred method, be it in-person, by mail, or digitally.

Who Needs Examples Pay Stubs:

01

Employees: Pay stubs are essential for employees as they provide detailed information about their earnings and deductions. They help employees track their income, understand tax withholdings, and ensure accurate payment from their employers.

02

Employers: Employers need examples pay stubs as they serve as proof of payment for their employees. Pay stubs also ensure transparency and compliance with labor laws, making them a necessary document for employers to maintain.

03

Financial Institutions: Lenders, banks, or other financial institutions may request examples pay stubs from individuals as part of their loan or credit application process. It helps them assess the individual's income stability and ability to repay borrowed funds.

In conclusion, filling out examples pay stubs correctly is essential for both employees and employers. Pay stubs serve as an official record of income, deductions, and payment, providing transparency and accountability in the employment relationship. Additionally, financial institutions may require pay stubs when evaluating an individual's financial capacity for credit or loan applications.

Fill

form

: Try Risk Free

People Also Ask about

What should a pay stub include?

What Information Is Included on a Pay Stub? Pay Date and Pay Period. The pay date is the actual day that the employee gets paid, and the pay period is the length of time that the pay date covers. Gross Wages. Hours Worked. Pay Rate. Pretax and After-Tax Deductions. Taxable Wages. Taxes. Year-to-Date Wages and Deductions.

What is the best pay stub generator?

Best pay stub generators for quick and professional pay stubs Shopify pay stub generator. Wix Pay Stub Generator. Wave Financial pay stub generator. ClickFunnels Paystub Maker Tool. 123 PayStubs. Form Pros Pay Stub Maker. ThePayStubs.

How do I prove my self-employed income?

Some ways to prove self-employment income include: Annual Tax Return (Form 1040) This is the most credible and straightforward way to demonstrate your income over the last year since it's an official legal document recognized by the IRS. 1099 Forms. Bank Statements. Profit/Loss Statements. Self-Employed Pay Stubs.

How do you format a pay stub?

What should a pay stub include? Employer information (company's name and address), Employee information (employee's name, address, ID number, and Social Security number), Reporting period and pay date, The hours worked and employee's hourly rate, Bonuses (if applicable), Total gross earnings,

Can you make your own pay stubs if self-employed?

If you're self-employed, you won't be given a paystub like you would from an employer. Making a self-employed paycheck stub can be done in various ways and the process doesn't take long. Providing that you have a recent check or bank statement, you can start making them.

How do you get pay stubs if you are self employed?

Since independent contractors are self-employed, they do not receive independent contractor pay stubs from their employer. However, contractors must draw up their own pay stubs for each client to get the payment for their services.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send teacher pay stub example to be eSigned by others?

To distribute your teacher pay stub example, simply send it to others and receive the eSigned document back instantly. Post or email a PDF that you've notarized online. Doing so requires never leaving your account.

How do I edit teacher pay stub example in Chrome?

Add pdfFiller Google Chrome Extension to your web browser to start editing teacher pay stub example and other documents directly from a Google search page. The service allows you to make changes in your documents when viewing them in Chrome. Create fillable documents and edit existing PDFs from any internet-connected device with pdfFiller.

How do I edit teacher pay stub example straight from my smartphone?

You can easily do so with pdfFiller's apps for iOS and Android devices, which can be found at the Apple Store and the Google Play Store, respectively. You can use them to fill out PDFs. We have a website where you can get the app, but you can also get it there. When you install the app, log in, and start editing teacher pay stub example, you can start right away.

What is examples pay stubs as?

Examples of pay stubs are documents detailing an employee's earnings, taxes withheld, and other deductions for a specific pay period.

Who is required to file examples pay stubs as?

Employers are required to provide pay stubs to their employees, usually on each payday, detailing the payments and deductions.

How to fill out examples pay stubs as?

To fill out a pay stub, include the employee's name, pay period date, gross earnings, taxes withheld, deductions, and net pay.

What is the purpose of examples pay stubs as?

The purpose of pay stubs is to provide employees with a clear record of their earnings and deductions, ensuring transparency in compensation.

What information must be reported on examples pay stubs as?

Pay stubs must report employee information such as name, pay period, gross pay, net pay, federal and state taxes withheld, and any other deductions.

Fill out your teacher pay stub example online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Teacher Pay Stub Example is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.