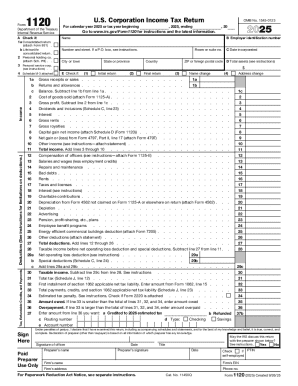

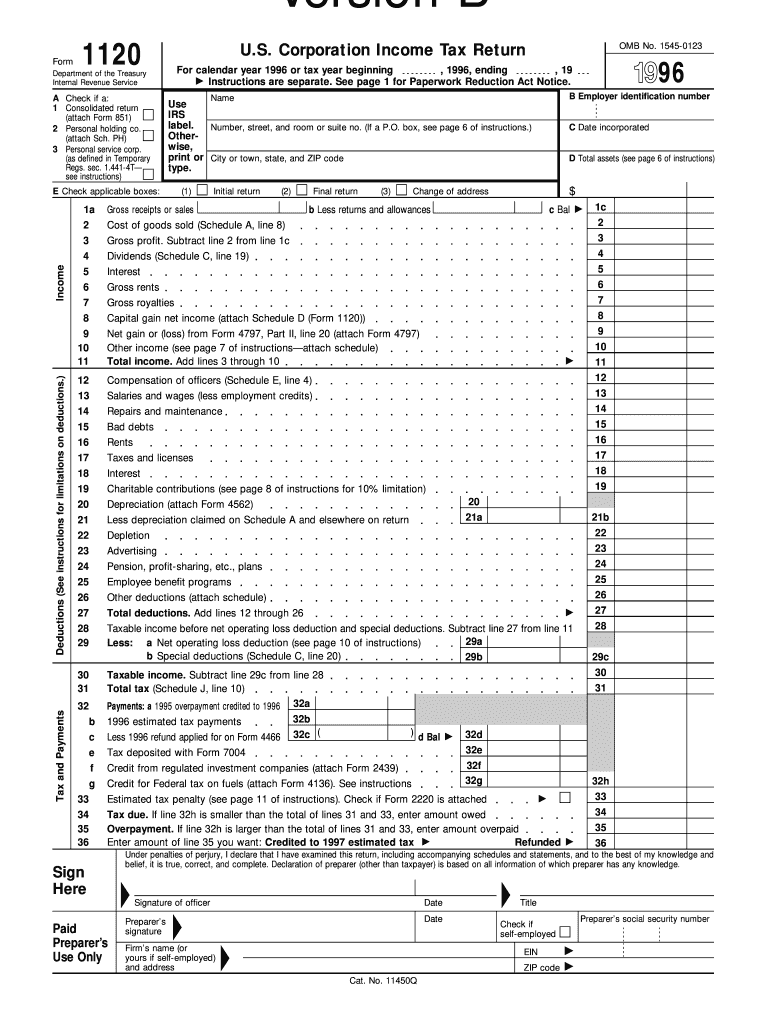

IRS 1120 1996 free printable template

Instructions and Help about IRS 1120

How to edit IRS 1120

How to fill out IRS 1120

About IRS previous version

What is IRS 1120?

When am I exempt from filling out this form?

What are the penalties for not issuing the form?

Is the form accompanied by other forms?

What is the purpose of this form?

Who needs the form?

Components of the form

What information do you need when you file the form?

Where do I send the form?

FAQ about IRS 1120

What should you do if you realize you made an error after filing the 1996 form 1120?

If you discover an error after submitting your 1996 form 1120, you should file an amended return using form 1120X. This allows you to correct any mistakes in the original filing while ensuring compliance with IRS requirements. Familiarize yourself with the rules regarding amended returns to avoid potential pitfalls and ensure your corrections are accurately processed.

How can a taxpayer verify whether their 1996 form 1120 has been received and processed?

Taxpayers can track the status of their 1996 form 1120 by using the IRS's online tools or by calling the agency's customer service. It's important to keep your details ready, such as the business name, EIN, and filing date, to enable the agent to assist you effectively. Verifying your submission helps in identifying any potential issues early in the process.

Are there common mistakes to avoid when filing the 1996 form 1120?

Some common mistakes include miscalculating deductions or failing to report certain income sources on the 1996 form 1120. Incomplete information or inconsistencies with prior returns can lead to processing delays or rejections. Careful review and cross-checking data against your records can significantly reduce such errors.

What should you do if you receive a notice from the IRS after filing the 1996 form 1120?

If you receive a notice from the IRS regarding your 1996 form 1120, it is crucial to read the communication carefully to understand the issue raised. Prepare the necessary documentation to respond, addressing the specific concerns highlighted, and ensure to reply by the deadline stated in the notice to avoid additional penalties.

See what our users say