Get the free td ameritrade roth conversion form

Show details

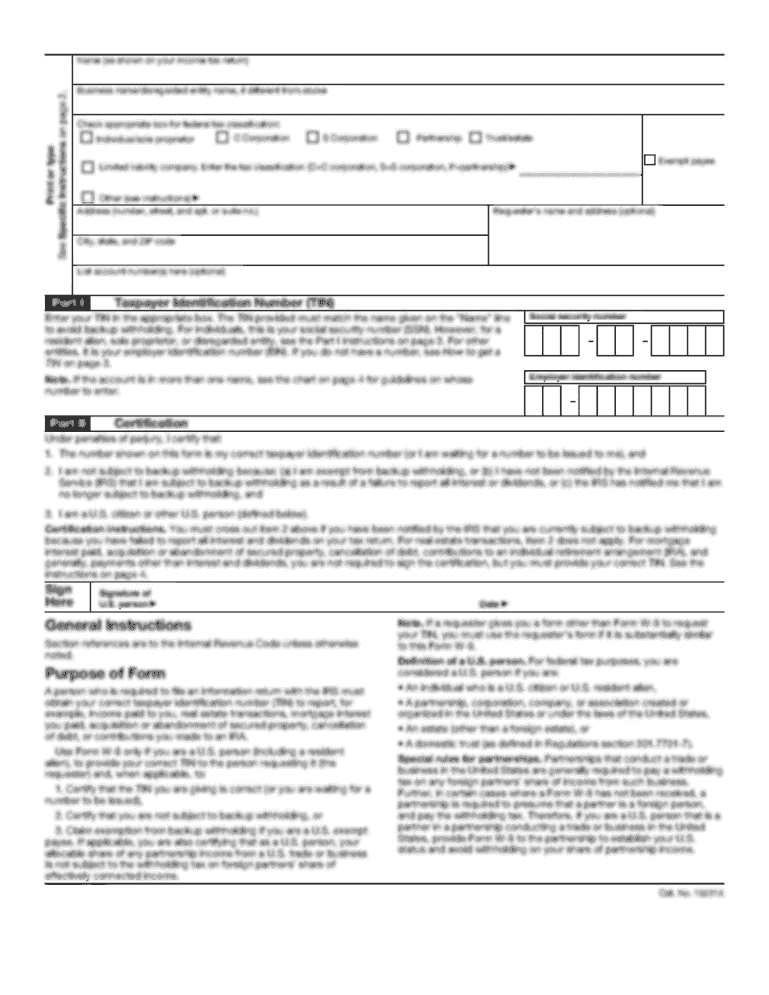

Reset Form Roth Conversion Form PO Box 2760 Omaha NE 68103-2760 Fax 866-468-6268 Questions Call an IRA representative at 888-723-8504 Option 2. 1. Account Owner Information Full Legal Name Date of Birth MM-DD-YYYY U.S. Social Security Number SSN Address of Record City State Primary Phone ZIP Code Email Address Should TD Ameritrade need to contact you in regards to this request your preferred method of contact is M Email 2. 1. Account Owner Inf...

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign td ameritrade roth conversion

Edit your td ameritrade roth conversion form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your td ameritrade roth conversion form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit td ameritrade roth conversion online

To use the services of a skilled PDF editor, follow these steps below:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit td ameritrade roth conversion. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

With pdfFiller, it's always easy to work with documents. Try it out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out td ameritrade roth conversion

How to fill out TD Ameritrade Roth Conversion:

01

Log in to your TD Ameritrade account using your username and password.

02

Navigate to the "Accounts" tab and select the Roth IRA account you wish to convert.

03

Click on the "Transfers & Withdrawals" option and then choose "Convert to Roth IRA" from the dropdown menu.

04

Provide the necessary details such as the amount you want to convert and the source account from which the funds will be transferred.

05

Review the conversion details and ensure they are correct. Make any necessary adjustments if needed.

06

Confirm the conversion by clicking on the "Submit" button. You may be required to go through additional steps for verification purposes.

07

Keep track of the transaction status through your TD Ameritrade account. Once the conversion is completed, you will receive a confirmation.

Who needs TD Ameritrade Roth Conversion:

01

Individuals who wish to convert their traditional IRA or employer-sponsored retirement plan (401k, 403b, etc.) to a Roth IRA may need to utilize TD Ameritrade's Roth Conversion service.

02

Investors who want to take advantage of the potential tax benefits offered by a Roth IRA, such as tax-free growth and tax-free qualified withdrawals, may opt for TD Ameritrade Roth Conversion.

03

Individuals who anticipate being in a lower tax bracket in the current year compared to their future retirement years may consider converting their retirement savings to a Roth IRA to potentially reduce future tax liabilities.

Fill

form

: Try Risk Free

People Also Ask about

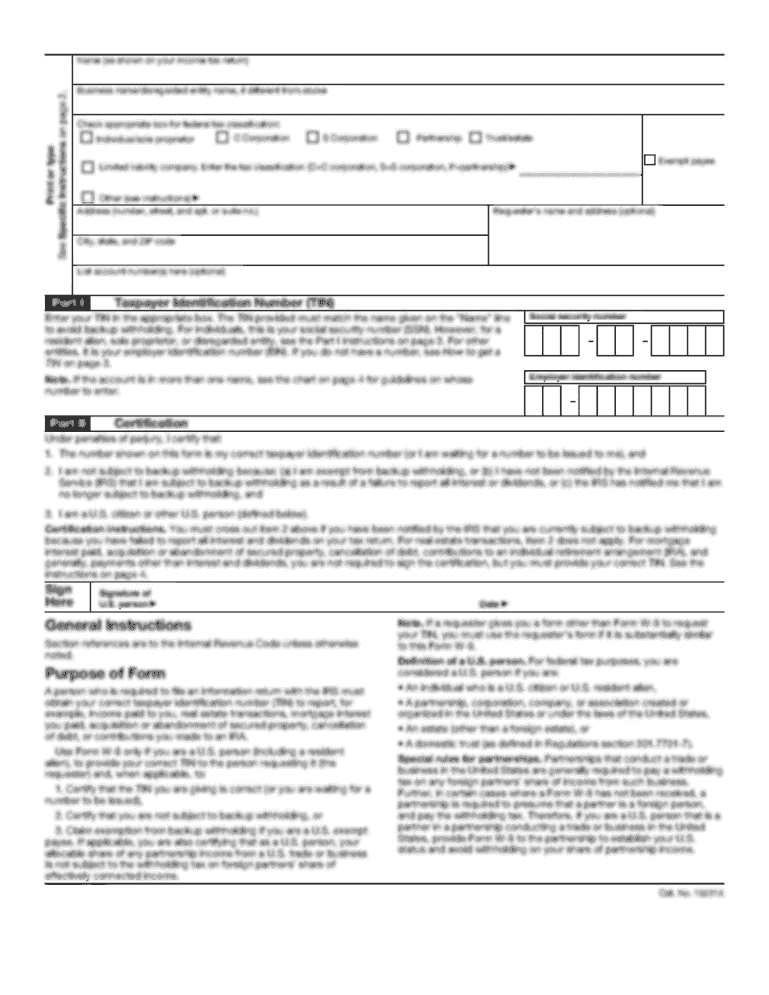

How do I report Roth conversion on 1099?

If you completed a Roth conversion in 2022, you'll receive Form 1099-R from your custodian, which includes the distribution from your IRA, Guarino said. You'll need to report the transfer on Form 8606 to tell the IRS which portion of your Roth conversion is taxable, he said.

How to convert 401k to Roth IRA TD Ameritrade?

Roll over your old 401k to TD Ameritrade in three simple steps: Open a TD Ameritrade IRA. Take 15 minutes** to open your IRA online. Fund your account. You will need to request a transfer of funds from the plan administrator of your previous employer-sponsored retirement plan. Build your portfolio.

What form do I fill out for Roth conversion?

Use Form 8606 to report: Nondeductible contributions you made to traditional IRAs. Distributions from traditional, SEP, or SIMPLE IRAs, if you have ever made nondeductible contributions to traditional IRAs. Conversions from traditional, SEP, or SIMPLE IRAs to Roth IRAs.

What tax form is used for Roth conversion?

Use Form 8606 to report: Nondeductible contributions you made to traditional IRAs. Distributions from traditional, SEP, or SIMPLE IRAs, if you have ever made nondeductible contributions to traditional IRAs. Conversions from traditional, SEP, or SIMPLE IRAs to Roth IRAs.

Can I do a Roth conversion on TD Ameritrade?

If you want to open a Roth IRA and make your conversion with the custodian you already have, you can ask for help. TD Ameritrade can help you take the next steps. Our team of rollover consultants can help you through the process.

What 1099 form do I use for Roth conversion?

If you completed a Roth conversion in 2022, you'll receive Form 1099-R from your custodian, which includes the distribution from your IRA, Guarino said. You'll need to report the transfer on Form 8606 to tell the IRS which portion of your Roth conversion is taxable, he said.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find td ameritrade roth conversion?

The premium version of pdfFiller gives you access to a huge library of fillable forms (more than 25 million fillable templates). You can download, fill out, print, and sign them all. State-specific td ameritrade roth conversion and other forms will be easy to find in the library. Find the template you need and use advanced editing tools to make it your own.

How do I edit td ameritrade roth conversion on an iOS device?

Create, modify, and share td ameritrade roth conversion using the pdfFiller iOS app. Easy to install from the Apple Store. You may sign up for a free trial and then purchase a membership.

How do I edit td ameritrade roth conversion on an Android device?

With the pdfFiller mobile app for Android, you may make modifications to PDF files such as td ameritrade roth conversion. Documents may be edited, signed, and sent directly from your mobile device. Install the app and you'll be able to manage your documents from anywhere.

What is td ameritrade roth conversion?

TD Ameritrade Roth conversion refers to the process of converting a traditional IRA or other tax-deferred retirement accounts into a Roth IRA through TD Ameritrade, allowing for tax-free withdrawals in retirement.

Who is required to file td ameritrade roth conversion?

Individuals who convert their traditional IRA or retirement accounts to a Roth IRA are required to report the conversion on their tax returns. This may include those whose income limits allow for Roth contributions.

How to fill out td ameritrade roth conversion?

To fill out a TD Ameritrade Roth conversion, complete the conversion form provided by TD Ameritrade, indicating the amount to be converted, and submit it along with any required documentation.

What is the purpose of td ameritrade roth conversion?

The purpose of a TD Ameritrade Roth conversion is to allow individuals to take advantage of tax-free growth and withdrawals in retirement by paying taxes on the converted amount now.

What information must be reported on td ameritrade roth conversion?

During a TD Ameritrade Roth conversion, individuals must report the amount converted from the traditional IRA to the Roth IRA on their tax return, along with any applicable taxes owed on the converted amount.

Fill out your td ameritrade roth conversion online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Td Ameritrade Roth Conversion is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.