Get the free loan payment receipt pdf

Fill out, sign, and share forms from a single PDF platform

Edit and sign in one place

Create professional forms

Simplify data collection

Manage forms centrally

Why pdfFiller is the best tool for your documents and forms

End-to-end document management

Accessible from anywhere

Secure and compliant

Comprehensive Guide to Loan Payment Receipt PDF Form

What is a loan payment receipt?

A loan payment receipt is a document provided to a borrower upon making a payment toward their loan. It serves as proof of payment and includes critical loan information, helping both the lender and borrower maintain accurate financial records. Ensuring you have a reliable loan payment receipt is not only important for record-keeping but also plays a crucial role in legal scenarios.

Why is it important to keep a loan payment receipt?

Maintaining an accurate record of loan payments is essential for several reasons. First, it provides confirmation of a borrower’s payment history, which is vital for understanding outstanding debts. Additionally, these receipts can help in dispute resolution if a payment is questioned or lost.

-

An accurate receipt may act as a legal document, establishing your payment history as protection against future claims.

-

It assists individuals in managing their finances and understanding their debt obligations.

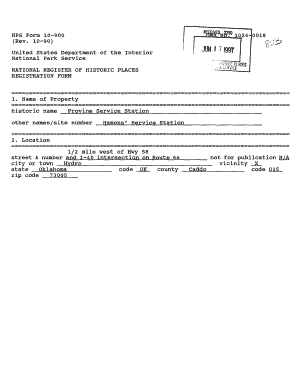

What are the essential elements of a loan payment receipt?

To effectively serve its purpose, a loan payment receipt should contain several key elements. These not only provide clarity but also ensure all parties involved have a mutual understanding of the transaction.

-

Specify the exact amount paid and any remaining balance to clarify the borrower’s obligations.

-

Include the borrower's name, address, and contact information.

-

Include the lender’s name or company, contact details, and address.

-

Insert the date when payment was made and any transaction identifiers for reference.

-

Provide spaces for both the borrower and lender to sign, confirming the transaction.

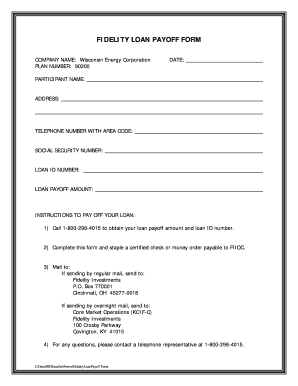

How do you fill out a loan payment receipt PDF form?

Filling out a loan payment receipt PDF form involves several straightforward steps to ensure accuracy and compliance.

-

Begin by locating a loan payment receipt template on pdfFiller, which simplifies the process.

-

Carefully input the amount being paid to ensure no discrepancies.

-

Provide complete and accurate contact information for both parties.

-

Utilize pdfFiller’s e-signature feature for a secure and valid acknowledgment.

-

Once completed, save the document securely for future reference.

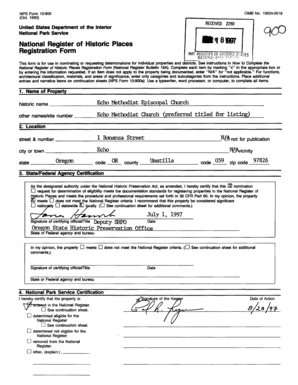

How can you edit and customize your loan payment receipt?

When utilizing pdfFiller, you benefit from various editing tools that allow customization of your loan payment receipt.

-

Adjust fields according to your specific needs while ensuring all essential information is included.

-

Include additional fields if your transaction includes unique terms or specific agreements.

-

Utilize design templates for a professional and organized appearance, something that can enhance your documentation.

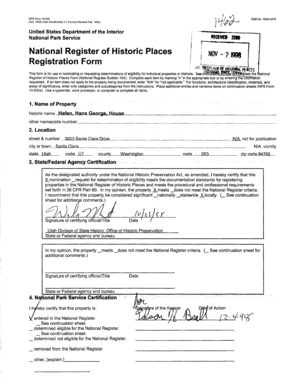

What special considerations are there for business loan receipts?

Business transactions often differ from personal loans and require specific terms and conditions. Understanding these differences can ensure legality and compliance.

-

Business loans typically involve larger sums and more complex terms.

-

Include specific terms reflecting the business nature of the transaction.

-

Be aware of tax implications and legal requirements that apply to business documentation.

What common mistakes should be avoided with loan payment receipts?

Even seemingly minor errors in loan payment receipts can lead to significant problems. Here are common pitfalls to avoid.

-

Double-check the payment amounts entered to avoid confusion and disputes in the future.

-

Ensure all necessary information regarding the borrower and lender is included.

-

Failing to have signatures could render the document less effective or valid.

What are the best practices for storing loan payment receipts?

Properly storing loan payment receipts is crucial for easy access and ensuring their longevity.

-

Create a systematic filing system to keep receipts organized for easy retrieval.

-

Storing documents on the cloud enhances security while providing access from various devices.

-

Implement strategies for regularly reviewing and managing documentation.

How can pdfFiller enhance your document management?

pdfFiller provides a comprehensive set of tools that streamline the process of loan document management.

-

From editing to e-signing, pdfFiller offers a wide range of features designed for ease of use.

-

Using pdfFiller allows for efficient document creation and management, saving time and reducing errors.

-

The platform's collaborative features enable teams to work on documents together seamlessly.

Frequently Asked Questions about loan receipt template form

What should I do if a loan payment receipt is lost?

If a loan payment receipt is lost, contact your lender to request a duplicate. Keep records of any payments made to expedite the process and ensure your loan account reflects accurate information.

Are digital loan payment receipts legally binding?

Yes, digital receipts can be legally binding if they include necessary information and proper signatures. However, confirm your local regulations to ensure compliance.

How long should I keep loan payment receipts?

It's advisable to keep loan payment receipts for at least three to seven years, or longer, depending on local laws and personal situations. Maintaining records beyond this helps in case of disputes.

Can I customize my loan payment receipt?

Absolutely! You can use platforms like pdfFiller to edit and customize receipts to fit your specific needs. This flexibility is essential for businesses and personal use to ensure all necessary details are captured.

What makes a loan payment receipt different from other receipts?

A loan payment receipt specifically outlines the terms of a loan and confirms payment history, while other receipts may not contain this level of detail. Its specificity makes it vital for tracking loans effectively.

pdfFiller scores top ratings on review platforms