Get the free idbi bank fd form

Show details

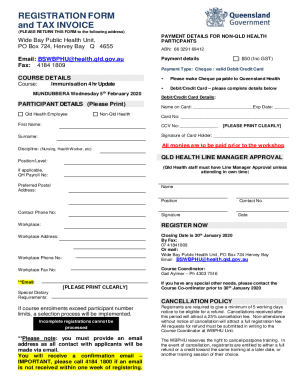

This document is an application form for opening a Suvidha Tax Saving Fixed Deposit Account for individuals and HUF (Hindu Undivided Family) at IDBI Bank.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign idbi fixed deposit form

Edit your idbi fd form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your idbi bank fd form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit idbi bank fd form online

To use our professional PDF editor, follow these steps:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit idbi bank fd form. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

With pdfFiller, dealing with documents is always straightforward.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out idbi bank fd form

How to fill out IDBI FD form:

01

Visit the official website of IDBI Bank or go to your nearest IDBI Bank branch.

02

Obtain the FD application form either from the website or from the branch.

03

Fill in your personal details accurately, including your name, address, contact information, and PAN card details.

04

Choose the type of FD scheme you wish to invest in and mention the amount you want to deposit.

05

Specify the tenure of the FD - whether it is for a specific number of days, months, or years.

06

Select the mode of interest payment – whether you want interest to be paid at maturity or at regular intervals.

07

Provide the necessary nomination details, including the name and contact information of the nominee.

08

Sign the form and attach any required documents, such as identity proof, address proof, and PAN card.

09

Double-check all the information provided and submit the completed form along with the required documents to the bank representative or at the designated counter.

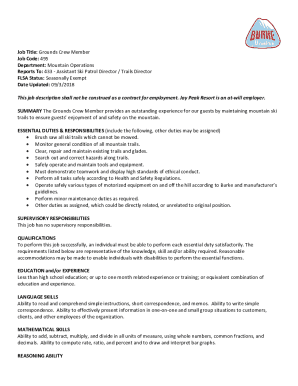

Who needs IDBI FD form:

01

Individuals who want to earn fixed returns on their savings and are looking for a safe investment option.

02

People who want to park their money for a specific period and receive regular interest payments or want to accumulate interest until maturity.

03

Investors who trust IDBI Bank and its financial stability and want to diversify their portfolio with FDs offered by a reputable bank.

04

Individuals who prefer the convenience of filling out a form and submitting it to the bank rather than investing through online platforms or other investment avenues.

05

Anyone who meets the eligibility criteria and has the necessary funds to invest in an IDBI FD can use the IDBI FD form to open an FD account.

Fill

form

: Try Risk Free

People Also Ask about

What is the minimum amount for fixed deposit in IDBI Bank?

The minimum investment in IDBI Bank FD is INR 10,000. However, there is no limit on the maximum amount of investment in IDBI Bank FD. What is senior citizen fixed deposit interest rates in IDBI Bank?

Can fixed deposit be opened online?

Fixed Deposit - Open FD Online Choose a tenure and amount of your choice to grow your income in a steady fashion. You can open an FD for as less as ₹ 5,000, and use it as a back-up for your savings or current account with Sweep-in and Super Saver Facilities.

What are the benefits of FD in IDBI Bank?

Features and Benefits of IDBI Fixed Deposits Auto-renewal facility is offered. Loans can be availed against the balance that is available in the account. Premature withdrawal facility is provided. However, a penalty will be levied in the case of premature withdrawal.

What is a fixed deposit form?

A fixed deposit (FD) is a tenured deposit account provided by banks or non-bank financial institutions which provides investors a higher rate of interest than a regular savings account, until the given maturity date. It may or may not require the creation of a separate account.

How can I apply for fixed deposit in IDBI online?

How to Apply for an IDBI Bank Fixed Deposit Step 1: Visit the IDBI Bank website and log in to the internet banking portal by providing username and password. Step 2: Once logged in, choose the 'Request' option. Step 3: Then choose the 'Opening a Fixed Deposit' option. Step 4: Choose the type of deposit to be opened.

What is the IDBI FD interest rate?

IDBI Bank FD Interest Rates 2023 TenureNormal Citizen FD RateSenior Citizen FD Rate6 months - 11 months 29 days5.75%6.25%11 months 30 days - 1 year 2 months 16 days6.8%7.3%11 months 30 days - 1 year 8 days6.8%7.3%1 year 9 days - 1 year 9 days7.1%7.6%10 more rows

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find idbi bank fd form?

The premium version of pdfFiller gives you access to a huge library of fillable forms (more than 25 million fillable templates). You can download, fill out, print, and sign them all. State-specific idbi bank fd form and other forms will be easy to find in the library. Find the template you need and use advanced editing tools to make it your own.

How do I fill out the idbi bank fd form form on my smartphone?

The pdfFiller mobile app makes it simple to design and fill out legal paperwork. Complete and sign idbi bank fd form and other papers using the app. Visit pdfFiller's website to learn more about the PDF editor's features.

How can I fill out idbi bank fd form on an iOS device?

Install the pdfFiller app on your iOS device to fill out papers. Create an account or log in if you already have one. After registering, upload your idbi bank fd form. You may now use pdfFiller's advanced features like adding fillable fields and eSigning documents from any device, anywhere.

What is idbi fd form?

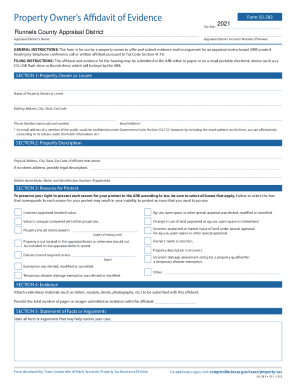

The IDBI FD form is a document used to open a fixed deposit account with IDBI Bank. It collects necessary information from the depositor for the processing of the fixed deposit.

Who is required to file idbi fd form?

Any individual or entity wishing to open a fixed deposit account with IDBI Bank is required to file the IDBI FD form.

How to fill out idbi fd form?

To fill out the IDBI FD form, provide personal details such as your name, address, contact information, and the amount to be deposited. You must also specify the tenure of the fixed deposit.

What is the purpose of idbi fd form?

The purpose of the IDBI FD form is to formally apply for a fixed deposit account and to provide the bank with the necessary information to manage the deposit.

What information must be reported on idbi fd form?

The IDBI FD form must report personal identification information, the amount to be deposited, tenure of the deposit, and the interest payout preferences.

Fill out your idbi bank fd form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Idbi Bank Fd Form is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.