American Financial Network Retail Compliance Review Loan Detail Checklist (TRID) 2015 free printable template

Show details

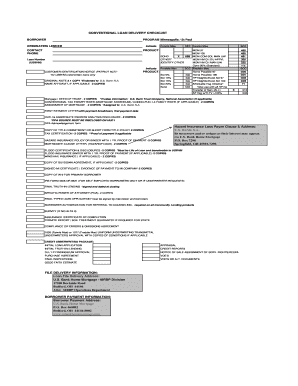

RETAIL COMPLIANCE REVIEW LOAN DETAIL CHECKLIST TRID Last Name First Name Loan Initial Intent to Proceed ITP LE 92900A FHA/VA Only LO Sig. Date Prep* Date Bwr. Sig. Date LE Date On ITP Date Locked Lock Exp* Date Compliance Auditor LE Date Date Reviewed Miscellaneous N/A LO signature and ALL Prep date are at most 3 days after AUS was run No Settlement/closing Agent is AFN Approved Yes LO s phone number is included on the initial 1003 LO is clear on Mavent and name matches Encompass and...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign American Financial Network Retail Compliance Review

Edit your American Financial Network Retail Compliance Review form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your American Financial Network Retail Compliance Review form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing American Financial Network Retail Compliance Review online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Log in to account. Click Start Free Trial and register a profile if you don't have one.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit American Financial Network Retail Compliance Review. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

With pdfFiller, it's always easy to deal with documents. Try it right now

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

American Financial Network Retail Compliance Review Loan Detail Checklist (TRID) Form Versions

Version

Form Popularity

Fillable & printabley

4.8 Satisfied (70 Votes)

4.4 Satisfied (70 Votes)

How to fill out American Financial Network Retail Compliance Review

How to fill out American Financial Network Retail Compliance Review Loan

01

Gather the necessary financial documentation, including income statements, tax returns, and credit information.

02

Obtain the American Financial Network Retail Compliance Review Loan application form from the official website or your financial advisor.

03

Fill out the application form carefully, providing accurate information in each section.

04

Attach all required financial documents to your application.

05

Review the entire application to ensure all information is complete and accurate.

06

Submit the application and documents to the American Financial Network for review.

07

Await feedback or additional requests for information from the compliance review team.

Who needs American Financial Network Retail Compliance Review Loan?

01

Individuals seeking to secure a loan through American Financial Network.

02

Homebuyers looking for financing options that comply with specific retail lending regulations.

03

Real estate professionals or agents assisting clients in the loan application process.

04

Borrowers needing a reliable and compliant financial solution for their mortgage needs.

Fill

form

: Try Risk Free

People Also Ask about

What does Trid compliant mean?

"TRID" is an acronym that some people use to refer to the TILA RESPA Integrated Disclosure rule. This rule is also known as the Know Before You Owe mortgage disclosure rule and is part of our Know Before You Owe mortgage initiative. Learn more about Know Before You Owe.

What is the 3 day rule how does it apply to the loan estimate and closing disclosure?

Consumers must receive the Closing Disclosure no later than three business days before consummation of their loan. The forms use clear language and design to make it easier for consumers to locate key information, such as interest rate, monthly payments, and costs to close the loan.

What is the Trid 3 day rule?

Generally, a creditor is responsible for ensuring that a Loan Estimate is delivered to a consumer or placed in the mail to the consumer no later than the third business day after receipt of the consumer's “application” for a mortgage loan subject to the TRID Rule.

What is a 3 day Trid waiting period?

§1026.19 (e)(3)(iv)(D) If the Loan Estimate is required to be redisclosed due to a Rate Lock it must be delivered to the borrower within 3(three) days of lock in of the interest rate. The consumer must receive the corrected Loan Estimate no later than 4 (four) business days before consummation.

What are the 6 Trid requirements?

What 6 Pieces of Information Make A TRID Loan Application? Name. Income. Social Security Number. Property Address. Estimated Value of Property. Mortgage Loan Amount sought.

What is the 3 day rule for closing?

Your lender is required by law to give you the standardized Closing Disclosure at least 3 business days before closing. This is what is known as the Closing Disclosure 3-day rule. This requirement is thanks to the TILA-RESPA Integrated Disclosures guidelines, which went into effect on October 3, 2015.

What are Trid compliance rules?

TRID is a series of guidelines enforced by the Consumer Financial Protection Bureau (CFPB) that tries to close some of the loopholes that dishonest lenders have used in the past to trick consumers. TRID rules dictate what mortgage information lenders need to provide to borrowers and when they must provide it.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I create an electronic signature for the American Financial Network Retail Compliance Review in Chrome?

Yes. You can use pdfFiller to sign documents and use all of the features of the PDF editor in one place if you add this solution to Chrome. In order to use the extension, you can draw or write an electronic signature. You can also upload a picture of your handwritten signature. There is no need to worry about how long it takes to sign your American Financial Network Retail Compliance Review.

How do I edit American Financial Network Retail Compliance Review straight from my smartphone?

The best way to make changes to documents on a mobile device is to use pdfFiller's apps for iOS and Android. You may get them from the Apple Store and Google Play. Learn more about the apps here. To start editing American Financial Network Retail Compliance Review, you need to install and log in to the app.

How do I fill out the American Financial Network Retail Compliance Review form on my smartphone?

Use the pdfFiller mobile app to fill out and sign American Financial Network Retail Compliance Review on your phone or tablet. Visit our website to learn more about our mobile apps, how they work, and how to get started.

What is American Financial Network Retail Compliance Review Loan?

The American Financial Network Retail Compliance Review Loan is a process designed to ensure that retail loan transactions comply with federal and state regulations, as well as internal policies, to promote ethical lending practices.

Who is required to file American Financial Network Retail Compliance Review Loan?

Lenders and financial institutions that offer retail loans through American Financial Network are required to file the Retail Compliance Review Loan to demonstrate compliance with relevant regulations.

How to fill out American Financial Network Retail Compliance Review Loan?

To fill out the American Financial Network Retail Compliance Review Loan, individuals must provide detailed information about the loan transaction, borrower details, compliance checks performed, and any relevant supporting documentation.

What is the purpose of American Financial Network Retail Compliance Review Loan?

The purpose of the American Financial Network Retail Compliance Review Loan is to ensure that lenders are adhering to legal and regulatory requirements in their loan practices, thereby reducing the risk of non-compliance and protecting consumers.

What information must be reported on American Financial Network Retail Compliance Review Loan?

Information that must be reported includes loan amount, borrower information, terms of the loan, compliance checks conducted, and any findings or corrective actions taken as part of the review process.

Fill out your American Financial Network Retail Compliance Review online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

American Financial Network Retail Compliance Review is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.