WageWorks WW-COM-0907-PMB free printable template

Show details

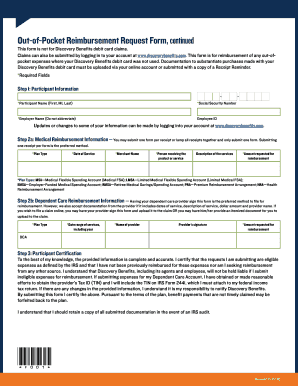

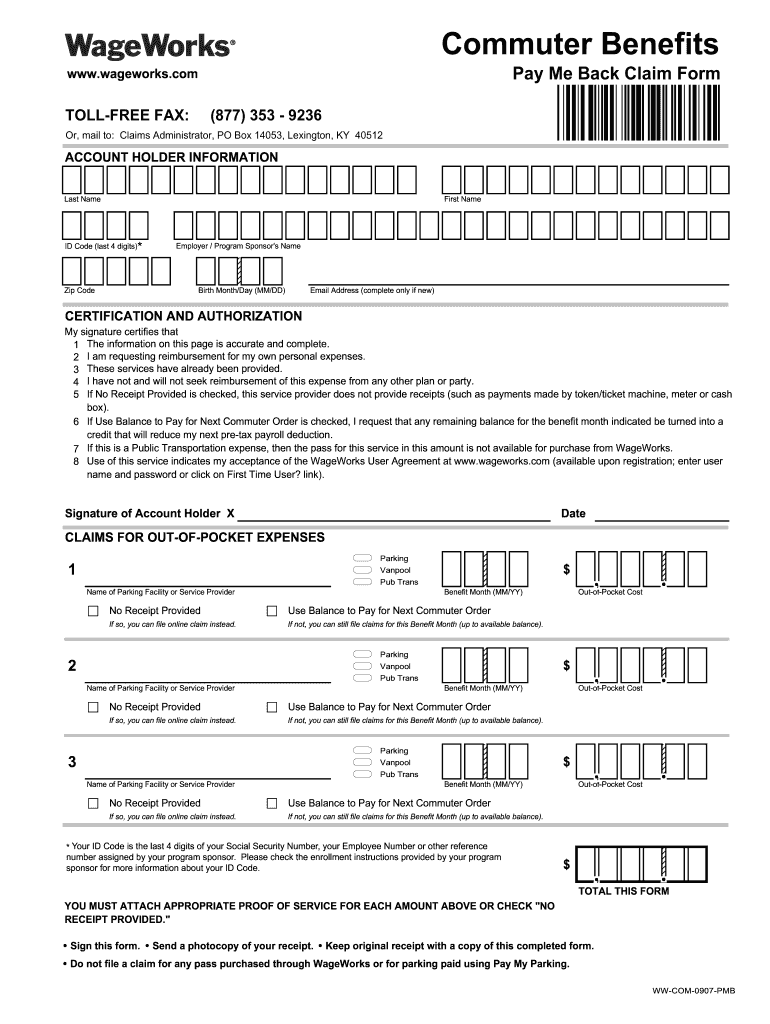

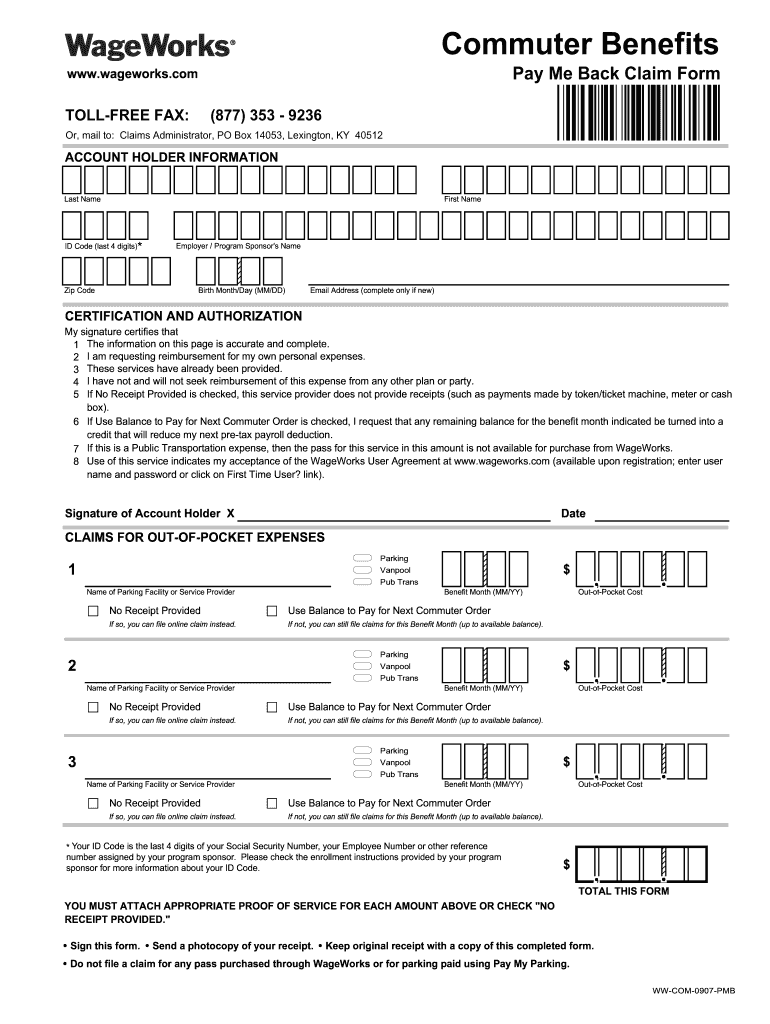

Commuter Benefits Pay Me Back Claim Form www. wageworks. com TOLL-FREE FAX 877 353 - 9236 Or mail to Claims Administrator PO Box 14053 Lexington KY 40512 WageWorks Pay Me Back Claim Form Instructions PLEASE READ THIS BEFORE SUBMITTING YOUR CLAIM FORM Your claim is important but in order for us to process it and your reimbursement quickly and fully we need you to completely and accurately fill out and submit the WageWorks Pay Me Back PMB claim form. To help you we ve provided the below...

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign pay me back claim pdf form

Edit your wage works pay claim form printable form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your wage works claim form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit wage works me claim form printable online

Use the instructions below to start using our professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit pay me back form printable. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

With pdfFiller, it's always easy to work with documents. Try it!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

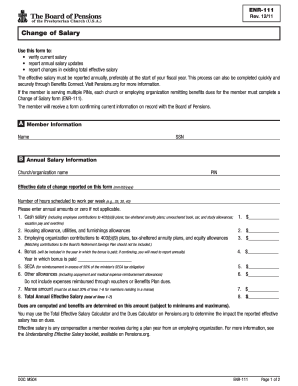

How to fill out wageworks reimbursement form

How to fill out WageWorks WW-COM-0907-PMB

01

Obtain the WageWorks WW-COM-0907-PMB form from the WageWorks website or your HR department.

02

Begin by filling out your personal information: name, address, and employee ID.

03

Enter the details of your dependent care expenses, including the provider's name, address, and tax ID number.

04

Specify the dates of the service provided and the total amount paid during that period.

05

Include any additional information requested on the form, such as the type of service provided.

06

Review the completed form for accuracy and completeness.

07

Sign and date the form before submission.

08

Submit the form to your employer or directly to WageWorks, following the submission instructions provided.

Who needs WageWorks WW-COM-0907-PMB?

01

Employees who have incurred eligible dependent care expenses and wish to get reimbursed for those costs.

02

Individuals participating in a Dependent Care Flexible Spending Account (FSA) through their employer.

03

Anyone requiring documentation for tax purposes related to dependent care expenses.

Fill

wage me claim form printable

: Try Risk Free

People Also Ask about wageworks pay me back

When can I be reimbursed FSA?

Employers may make contributions to your FSA, but they aren't required to. With an FSA, you submit a claim to the FSA (through your employer) with proof of the medical expense and a statement that it hasn't been covered by your plan. Then, you'll get reimbursed for your costs.

When was WageWorks acquired by HealthEquity?

A: HealthEquity and WageWorks officially became one company August 30,2019. Although the deal is done, you will not see any disruption or changes in your service in the near term.

Who is HealthEquity owned by?

Dr. Stephen Neeleman is the founder and vice chairman of HealthEquity. Steve founded HealthEquity in 2002, with the vision to repair the fractured relationship between patients and their physicians and to help more people obtain quality health insurance by re-introducing consumerism to health care.

How long should a reimbursement take?

30 days after the employee submits their reimbursement request is the typical wait time to receive a compensation check.

How can I get reimbursement from WageWorks?

It's fast and easy. Just log into your WageWorks account on the EZ Receipts app, click Submit New Receipts, and follow the prompts to submit a claim and snap photos of your receipts to be reimbursed from your WageWorks account. You can also snap a picture and save the receipt to use later when you file your claim.

When can I get reimbursed for FSA?

It may take up to 10 to 12 business days from the time your FEHB plan submits your claim until your funds are deposited into your account. The payment schedule for retail and mail-order pharmacy vendors is generally longer than what you may experience for medical, dental and vision claims.

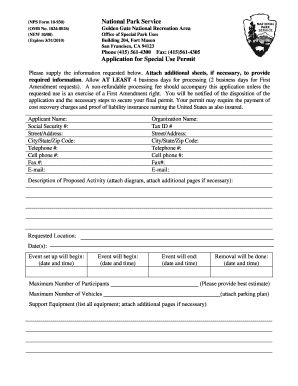

How do I request an FSA reimbursement?

Submit Your Claim in One of These Ways Log in to your account. Once you have logged into your account, click Submit Receipt or Claim and select your Reimbursement Option. Follow the step-by-step instructions. Upload digital copies of your itemized receipts (and other documentation if needed).

How long does it take to receive FSA reimbursement?

How long does it take to receive a reimbursement check from my Flexible Spending Accounts (FSA)? Generally, you receive your Healthcare FSA or Dependent Care FSA by direct deposit or check within two weeks after the claim and required documentation are received, approved, and processed.

How do I get my money from WageWorks?

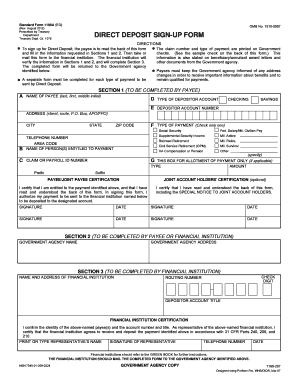

Log into your WageWorks account to submit a Pay Me Back claim. You can arrange to have a check mailed to you. Or, even faster and easier, you can have funds directly deposited into your bank account.

How does WageWorks pay back?

If you've already paid for an eligible expense out of your own pocket, you can arrange to pay yourself back from your WageWorks account in two ways: Have a check mailed to you; or. Have your reimbursements deposited directly into your bank account.

What is the deadline for FSA reimbursement 2022?

Remind your employees about the Medical FSA grace period. Some of your employees have Medical Flexible Spending Arrangement (FSA) funds they will soon lose. The last day they can apply these funds toward eligible expenses is March 15, 2022. The deadline to submit claims is March 31, 2022.

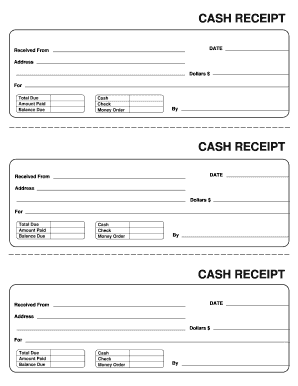

How do I submit a receipt for reimbursement?

How do I fill out a reimbursement expense receipt? Complete your company's expense reimbursement form by including an itemized list of expenses with totals. Next, attach a receipt for each item to the form and submit it to your manager or through your company's online portal.

How long does it take for FSA reimbursement direct deposit?

It may take up to 10 to 12 business days from the time your FEHB plan submits your claim until your funds are deposited into your account. The payment schedule for retail and mail-order pharmacy vendors is generally longer than what you may experience for medical, dental and vision claims.

Is WageWorks the same as HealthEquity?

HealthEquity and WageWorks have combined to create a new health savings and consumer-directed benefits partner for employers, benefits consultants, and health and retirement plan providers seeking to help working families connect health and wealth.

How do I submit a reimbursement to FSA?

Submit Your Claim in One of These Ways Log in to your account. Once you have logged into your account, click Submit Receipt or Claim and select your Reimbursement Option. Follow the step-by-step instructions. Upload digital copies of your itemized receipts (and other documentation if needed).

How long does it take to get reimbursed from WageWorks?

WageWorks will send you an email when we receive your claim documentation to let you know it's in the processing queue. Your claim will be processed in two to three business days.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send wageworks forms for eSignature?

To distribute your what is wageworks, simply send it to others and receive the eSigned document back instantly. Post or email a PDF that you've notarized online. Doing so requires never leaving your account.

Where do I find wageworks forms for reimbursement?

The premium version of pdfFiller gives you access to a huge library of fillable forms (more than 25 million fillable templates). You can download, fill out, print, and sign them all. State-specific wageworks medicare reimbursement form and other forms will be easy to find in the library. Find the template you need and use advanced editing tools to make it your own.

Can I create an electronic signature for signing my wageworks in Gmail?

With pdfFiller's add-on, you may upload, type, or draw a signature in Gmail. You can eSign your wagework and other papers directly in your mailbox with pdfFiller. To preserve signed papers and your personal signatures, create an account.

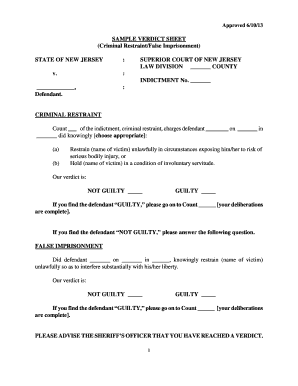

What is WageWorks WW-COM-0907-PMB?

WageWorks WW-COM-0907-PMB is a specific form used for the reporting and management of certain employee benefit plans related to pre-tax transportation and parking benefits.

Who is required to file WageWorks WW-COM-0907-PMB?

Employers offering pre-tax transportation and parking benefits to their employees are required to file the WageWorks WW-COM-0907-PMB form.

How to fill out WageWorks WW-COM-0907-PMB?

To fill out the WageWorks WW-COM-0907-PMB form, employers need to provide the necessary information such as employee details, benefit selections, and the associated costs, ensuring all fields are accurately completed.

What is the purpose of WageWorks WW-COM-0907-PMB?

The purpose of WageWorks WW-COM-0907-PMB is to document and report the qualified transportation expenses and benefits provided to employees, in compliance with IRS regulations.

What information must be reported on WageWorks WW-COM-0907-PMB?

The information that must be reported includes employee names, employer identification number (EIN), details of the pre-tax benefits provided, the amounts allocated, and any other relevant benefit information as required by the form.

Fill out your WageWorks WW-COM-0907-PMB online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

WageWorks WW-COM-0907-PMB is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.