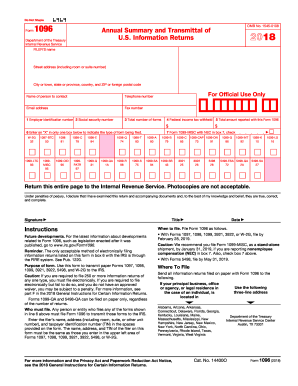

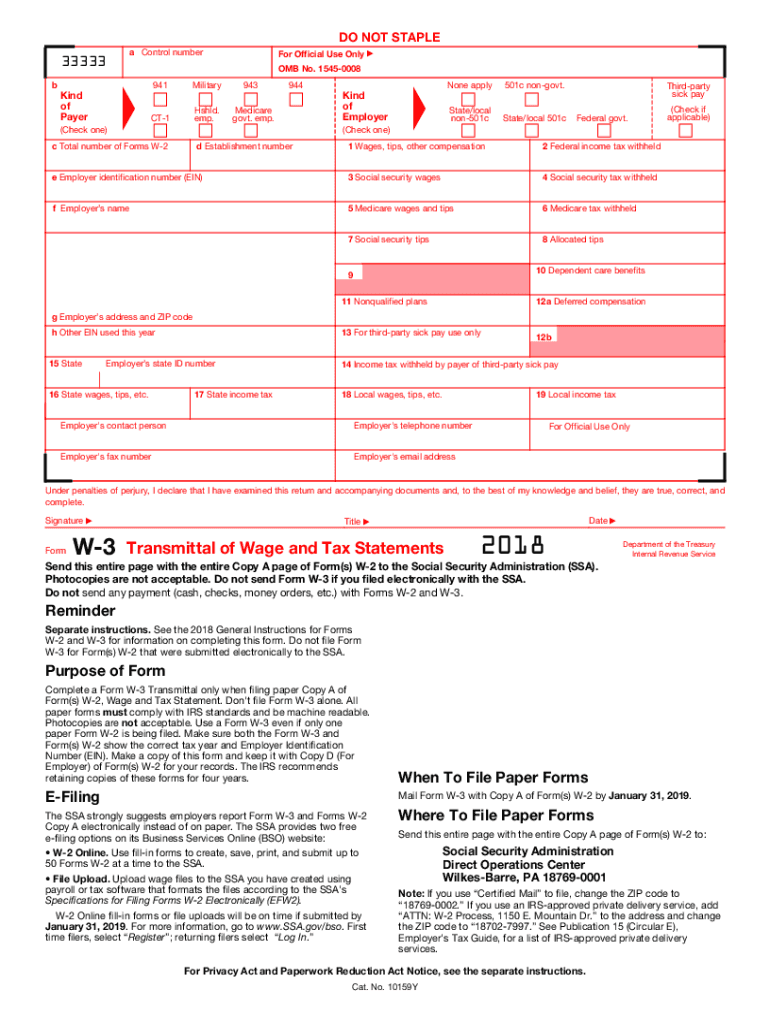

IRS W-3 2018 free printable template

Instructions and Help about IRS W-3

How to edit IRS W-3

How to fill out IRS W-3

About IRS W-3 2018 previous version

What is IRS W-3?

Who needs the form?

Components of the form

What information do you need when you file the form?

Where do I send the form?

What is the purpose of this form?

When am I exempt from filling out this form?

What are the penalties for not issuing the form?

Is the form accompanied by other forms?

FAQ about IRS W-3

What should I do if I need to correct an error on my IRS W-3 after filing?

If you need to amend your IRS W-3, you should file a corrected version of the form, marking it as corrected. Ensure that you also correct the corresponding Forms W-2 for accurate reporting. Keep documentation of the original submission and any communication with the IRS for your records.

How can I track the status of my submitted IRS W-3?

To verify the status of your IRS W-3, check the IRS e-Services or call their helpline for assistance. If you e-filed, look for common rejection codes that may indicate issues during processing, and be prepared to take action if needed to resolve any discrepancies.

Are e-signatures permissible when filing the IRS W-3 electronically?

Yes, e-signatures are accepted for electronically filed IRS W-3 forms. Ensure that the e-signature meets IRS requirements for authenticity and integrity. Always check the latest guidelines to stay compliant with IRS protocols regarding electronic submissions.

What steps should I take if I receive a notice from the IRS after submitting my W-3?

If you receive a notice from the IRS regarding your submitted W-3, carefully read the correspondence to understand the issue. Gather any requested documentation, and respond promptly within the specified timeframe, ensuring you include relevant facts and clarifications.

What are some common errors to avoid when submitting the IRS W-3?

Common mistakes in submitting the IRS W-3 include incorrect taxpayer identification numbers, mismatched totals with Forms W-2, and failing to sign or date the form. Double-check all entries and ensure all figures align with the original W-2 submissions for accuracy.

See what our users say