India FATCA Annexure free printable template

Show details

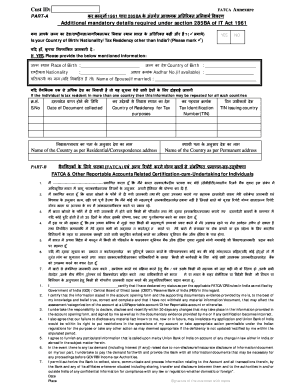

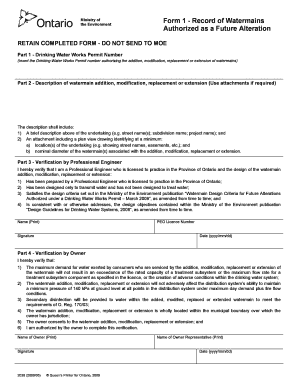

Date Place Signature of the customer with name General Guidelines for the FATCA Annexure FATCA annexure is mandatory for all Individual/Joint Individual accounts opened from 1. Cust ID FATCA Annexure 1961 285BA PART-A Additional mandatory details required under section 285BA of IT Act 1961 Place of Birth Nationality / Country of Birth Fathers name Name of Spouse if married Aadhar No. if available / / YES Is your Country of...

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign india fatca annexure form

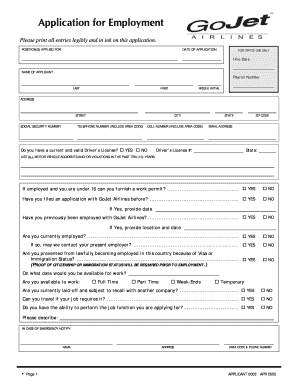

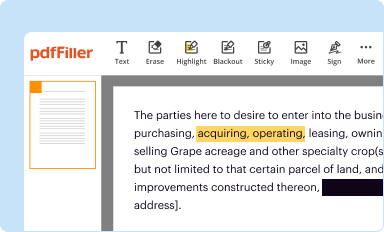

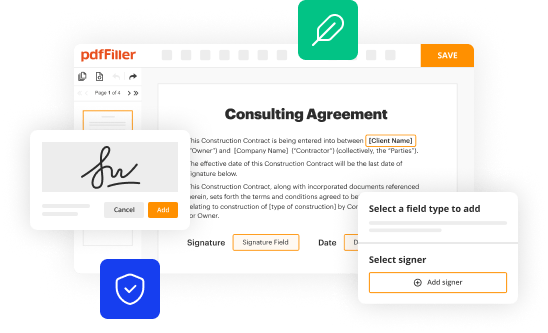

Edit your fatca form union bank of india pdf form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

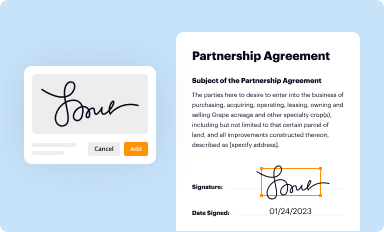

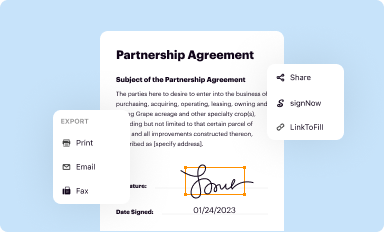

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your union bank fatca form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit fatca declaration form union bank of india online

Use the instructions below to start using our professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit 442827183 form. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out union bank fatca form pdf

How to fill out India FATCA Annexure

01

Obtain the India FATCA Annexure form from the official tax website or your financial institution.

02

Ensure all personal and financial details are accurate and up to date.

03

Provide your tax identification number (TIN) and other required identification details.

04

Fill out the sections related to your financial accounts, including account numbers and balances.

05

Report any foreign financial assets as required by the form.

06

Review the completed form for accuracy and compliance with FATCA regulations.

07

Submit the annexure electronically or in hard copy as instructed.

Who needs India FATCA Annexure?

01

Individuals who are U.S. citizens or U.S. persons and hold accounts in India.

02

Financial institutions in India that have U.S. account holder clients.

03

Entities that are required to report under the Foreign Account Tax Compliance Act (FATCA) regulations.

Fill

union bank of india fatca form pdf download

: Try Risk Free

People Also Ask about fatca annexure form union bank of india pdf download

How to fill Union Bank request form?

Register and sign in. Create a free account, set a secure password, and go through email verification to start working on your templates. Upload a document. Click on New Document and choose the form importing option: add Union bank request form from your device, the cloud, or a secure link.

Is FATCA declaration mandatory for Indian citizens?

Is every investor required to submit FATCA/CRS declaration? Yes, every customer who opens a new account with any mutual fund is required to give FATCA/CRS self-certification.

How do I fill a FATCA CRS declaration form for NRI?

How to fill FATCA CRS declaration for individual? Basic Information: In this field, you must provide your name, PAN Card number, and birthdate. Part 1: This part requires you to enter your birthplace, citizenship, legal address for tax reasons, and whether you are a US resident or not.

Who needs to fill out FATCA form?

FATCA requires certain U.S. taxpayers who hold foreign financial assets with an aggregate value of more than the reporting threshold (at least $50,000) to report information about those assets on Form 8938, which must be attached to the taxpayer's annual income tax return.

Who is exempt from FATCA?

Other Exceptions from Reporting Additional exceptions from reporting are made for certain trusts, certain assets held by bona fide residents of U.S. territories, and assets or accounts for which mark-to-market elections have been made under Internal Revenue Code Section 475.

Does FATCA apply to individuals?

FATCA applies to individual citizens, residents, and non-resident aliens. Residents and entities in U.S. territories must file FBARs but don't need to file FATCA forms.

How can I download Union Bank PDF?

Union Bank of India Netbanking One needs to login to the net banking account and select the transaction date range, the format for the account statement and click on the 'Statement' button. One will get the option to download UBI account statement PDF.

How to download Union Bank passbook online?

Steps For Union Bank of India Passbook Online Download Using UBI Mobile App Download and Register for the Union Bank of India Mobile App. Login into UBI Mobile App using your MPIN. Now tap on “Accounts” Then choose your account from the given options of Saving Account/Current Account/ Overdraft Account.

What is FATCA CRS declaration in India?

What is the purpose of FATCA/CRS? The purpose of FATCA is to prevent U.S. persons from using banks and other financial institutions outside the USA to park their wealth outside U.S. and consequently avoid U.S. taxation on income generated from such wealth.

What information is required for FATCA?

Account holders will be expected to provide details such as Country of Tax residence, Tax Identification Number from such country, Country of Birth, Country of Citizenship, etc. A separate form will be made available shortly, in which existing account holders will have to submit such information.

What is FATCA in India?

Requirements as per RBI: “FATCA” means Foreign Account Tax Compliance Act of the United States of America (USA) which, inter alia, requires foreign financial institutions to report about financial accounts held by U.S. taxpayers or foreign entities in which U.S. taxpayers hold a substantial ownership interest.

How to download interest certificate from Union Bank of India online?

Download Union Bank of India Home Loan Certificate Online Step 2: Enter your user ID and password, and then click on Login. Step-3: Once logged in, click on the Enquiries tab. Once you enter the Enquiries tab, select the 'Home Loan Provisional Certificate' option to access and download the certificate.

Is FATCA required for indian citizen?

Yes, every customer who opens a new account with any mutual fund is required to give FATCA/CRS self-certification.

How do I download Union Bank Service Request form?

Register and sign in. Create a free account, set a secure password, and go through email verification to start working on your templates. Upload a document. Click on New Document and choose the form importing option: add Union bank request form from your device, the cloud, or a secure link.

Is FATCA mandatory for nre?

NRIs investing in Mutual Funds All Indian mutual fund houses must adhere to the relevant regulations when they accept investment funds from NRI investors. ingly, they require a FATCA self-declaration by the NRIs and the resident country's Tax Residency Number.

How do I fill out a FATCA form?

You must now complete the FATCA declaration form with information such as your name, PAN number, nationality, residence, city, and country of birth, occupation, and income. If you are a resident of another country, you must additionally provide your tax residency number and click submit.

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get fatca annexure union bank of india?

It's simple with pdfFiller, a full online document management tool. Access our huge online form collection (over 25M fillable forms are accessible) and find the india fatca annexure in seconds. Open it immediately and begin modifying it with powerful editing options.

How do I make edits in fatca form pdf without leaving Chrome?

Get and add pdfFiller Google Chrome Extension to your browser to edit, fill out and eSign your fatca annexure, which you can open in the editor directly from a Google search page in just one click. Execute your fillable documents from any internet-connected device without leaving Chrome.

How do I edit fatca form india on an Android device?

Yes, you can. With the pdfFiller mobile app for Android, you can edit, sign, and share fatca india on your mobile device from any location; only an internet connection is needed. Get the app and start to streamline your document workflow from anywhere.

What is India FATCA Annexure?

The India FATCA Annexure is a form required to be filled out by financial institutions in India to comply with the Foreign Account Tax Compliance Act (FATCA), which is a United States law aimed at preventing tax evasion by U.S. persons holding accounts outside the United States.

Who is required to file India FATCA Annexure?

Financial institutions in India, such as banks, insurance companies, and mutual funds, that have U.S. clients or account holders are required to file the India FATCA Annexure.

How to fill out India FATCA Annexure?

To fill out the India FATCA Annexure, financial institutions must gather information about U.S. account holders, including their names, addresses, taxpayer identification numbers, and account details, and submit this information through the prescribed format to the Income Tax Department of India.

What is the purpose of India FATCA Annexure?

The purpose of the India FATCA Annexure is to facilitate the reporting of foreign financial assets held by U.S. taxpayers and ensure compliance with FATCA regulations, thereby promoting transparency and reducing tax evasion.

What information must be reported on India FATCA Annexure?

The information that must be reported on the India FATCA Annexure includes the account holder's name, taxpayer identification number, address, account number, account balance, and details of any payments made during the year that are subject to U.S. taxation.

Fill out your India FATCA Annexure online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Fatca Details Form Annexure Ii is not the form you're looking for?Search for another form here.

Keywords relevant to deposit form union bank

Related to declaration of tax residency for fatca crs reporting lic pdf

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.