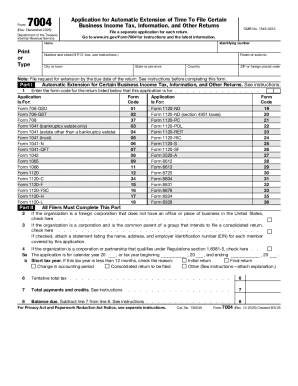

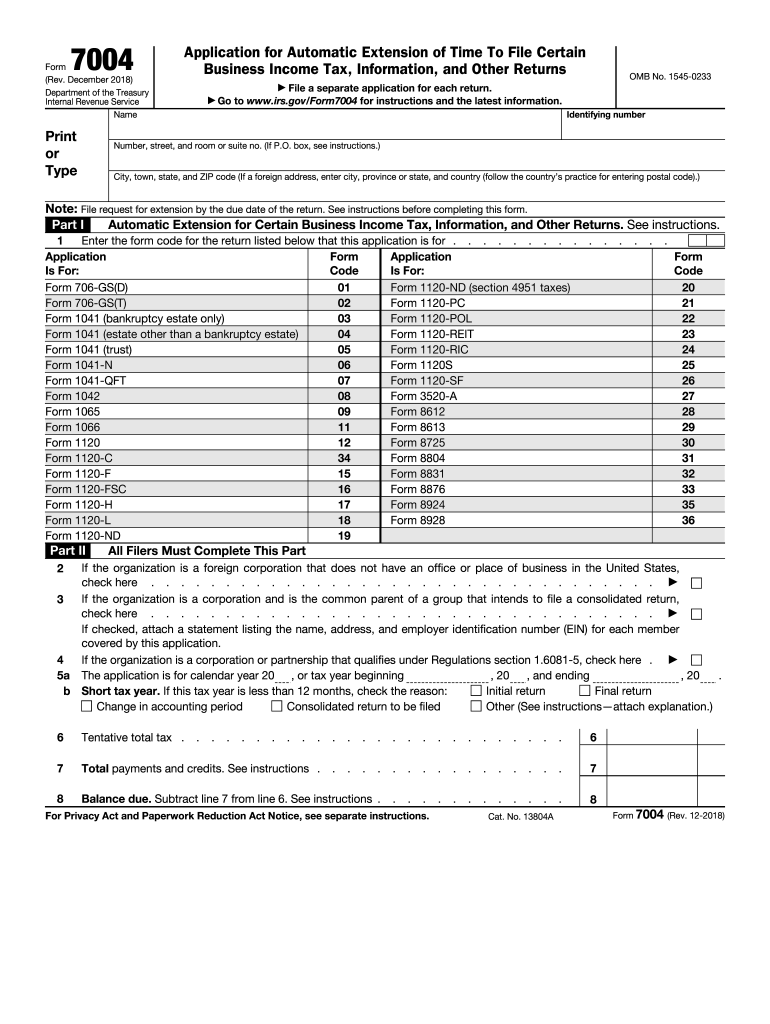

IRS 7004 2018 free printable template

Instructions and Help about IRS 7004

How to edit IRS 7004

How to fill out IRS 7004

Latest updates to IRS 7004

About IRS 7 previous version

What is IRS 7004?

Who needs the form?

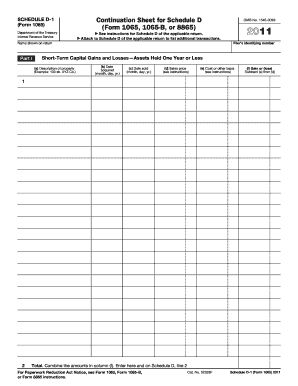

Components of the form

What information do you need when you file the form?

Where do I send the form?

What is the purpose of this form?

When am I exempt from filling out this form?

What are the penalties for not issuing the form?

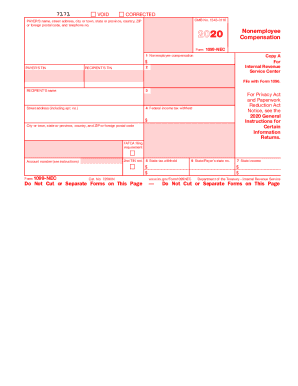

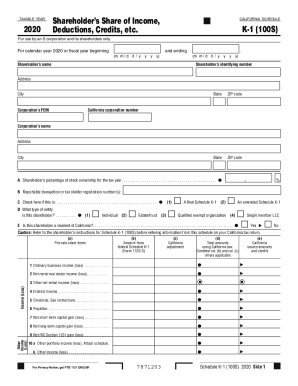

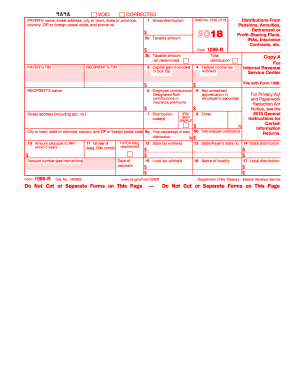

Is the form accompanied by other forms?

FAQ about IRS 7004

What should I do if I need to amend my already submitted IRS 7004?

If you discover an error after submitting your IRS 7004, you can amend it by filing a corrected version of the form. Be sure to indicate that it is a correction and include the correct information. It's advisable to keep a copy of your amended form along with any related correspondence for your records.

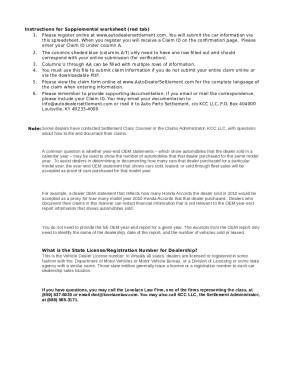

How can I check the status of my submitted IRS 7004?

To verify the status of your submitted IRS 7004, you can use the IRS e-file system to check for receipt and processing updates. If you filed by mail, it may take longer, but you can also contact the IRS directly for assistance with any tracking issues.

Are electronic signatures acceptable for IRS 7004 submissions?

Yes, the IRS accepts electronic signatures on the IRS 7004 form, provided you meet specific requirements. Ensure that your e-signature complies with IRS rules to protect the integrity of your submission and maintain data security.

What common errors should I watch out for when filing IRS 7004?

Common mistakes while filing IRS 7004 include incorrect tax identification numbers, failing to sign the form, and not providing accurate entity information. Review your form thoroughly before submission to prevent these issues and ensure a smoother filing process.

What should I do if I receive an audit notice related to IRS 7004?

If you receive an audit notice regarding your IRS 7004, it's crucial to gather all relevant documentation, including your submitted forms and any supporting materials. Respond promptly to the notice and consider consulting with a tax professional to navigate the audit process effectively.

See what our users say