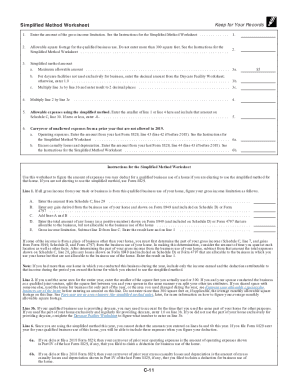

IRS Instructions 1040 Schedule C 2020 free printable template

Show details

If you are the sole member of a domestic LLC file Schedule C or C-EZ or Schedule E or F if applicable unless you have elected to treat the domestic LLC as a corporation. See Form 8832 for details on making this election and for information about the tax treatment of a foreign LLC. For details on reforestation expenses see chapters 7 and 8 of Pub. 535. Paperwork Reduction Act Notice. We ask for the information on Schedule C Form 1040 and Schedule C-EZ Form 1040 to carry out the Internal...

pdfFiller is not affiliated with IRS

Get, Create, Make and Sign IRS Instructions 1040 Schedule C

Edit your IRS Instructions 1040 Schedule C form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your IRS Instructions 1040 Schedule C form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit IRS Instructions 1040 Schedule C online

To use the professional PDF editor, follow these steps below:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit IRS Instructions 1040 Schedule C. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

With pdfFiller, it's always easy to deal with documents. Try it right now

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

IRS Instructions 1040 Schedule C Form Versions

Version

Form Popularity

Fillable & printabley

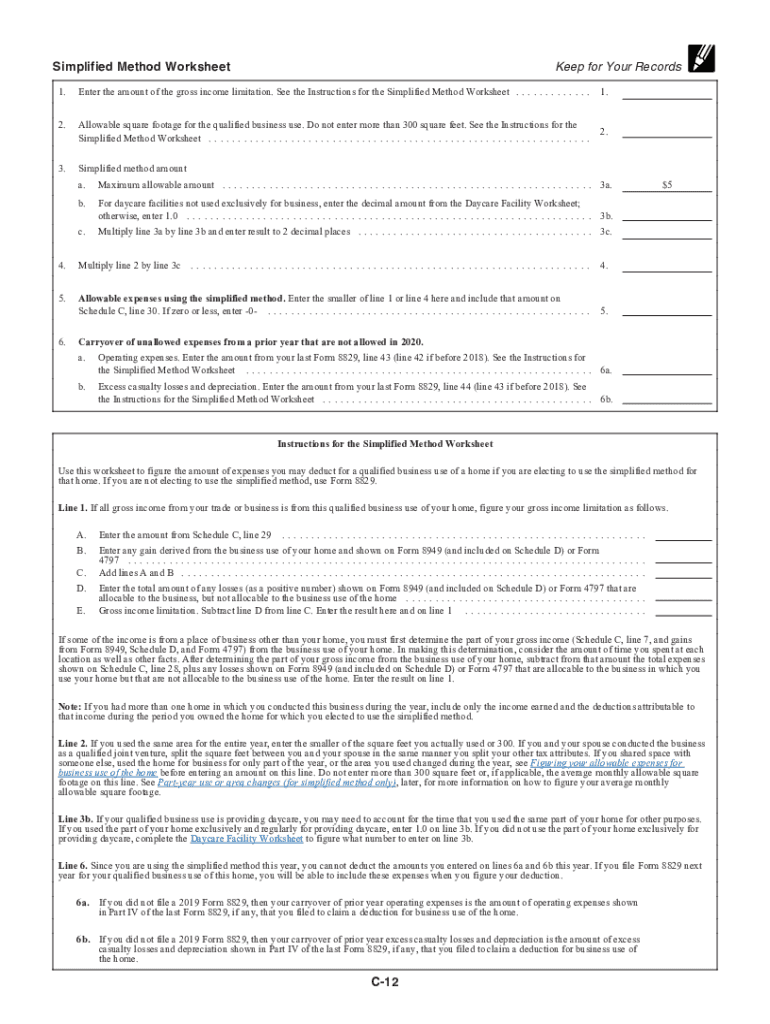

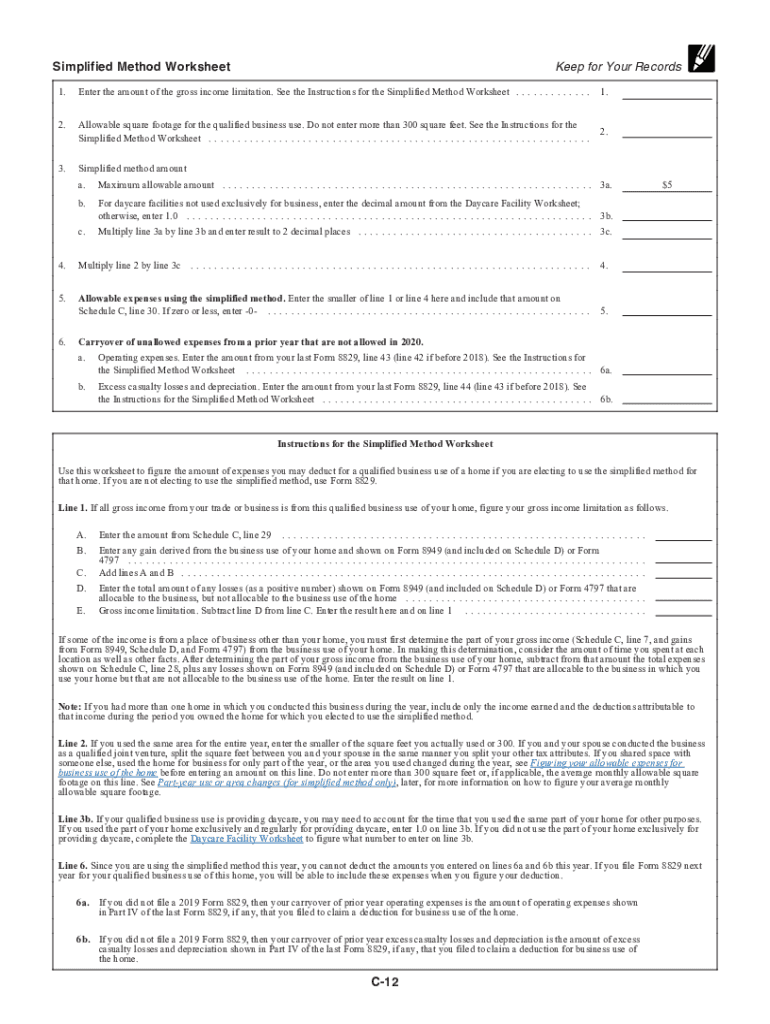

How to fill out IRS Instructions 1040 Schedule C

How to fill out IRS Instructions 1040 Schedule C

01

Start by gathering all necessary documentation, including income and expenses related to your business.

02

Download or obtain IRS Form 1040 Schedule C from the IRS website.

03

Fill in your name and Social Security number at the top of the form.

04

Indicate your principal business activity by describing your business type.

05

Enter your gross receipts or sales on line 1.

06

List your cost of goods sold if applicable, and subtract it from your gross receipts to calculate your gross profit.

07

Detail your business expenses by filling in the corresponding sections, such as advertising, car and truck expenses, employee wages, and rent.

08

Calculate your total expenses and subtract this amount from the gross profit to find your net profit or loss.

09

Transfer your net profit or loss to Form 1040, Schedule 1, and then to your main tax return.

Who needs IRS Instructions 1040 Schedule C?

01

Self-employed individuals who report income or losses from their business activities.

02

Freelancers and independent contractors who need to report earnings.

03

Business owners of sole proprietorships that do not operate as corporations or partnerships.

Fill

form

: Try Risk Free

People Also Ask about

How is Schedule C income taxed?

Using the entries on Schedule C, the taxpayer calculates the business's net profit or loss for income tax purposes. This figure is reported on Form 1040 and is then used to calculate the taxpayer's overall tax liability for the year.

Can I fill out my own Schedule C?

You will need to file Schedule C annually as an attachment to your Form 1040. The quickest, safest, and most accurate way to file is by using IRS e-file either online or through a tax professional that is an authorized IRS e-file provider. Here are a few tips for Schedule C filers. Keep good records.

Do you fill out your own Schedule C?

If you are self-employed, it's likely you need to fill out an IRS Schedule C to report how much money you made or lost in your business. Freelancers, contractors, side-giggers and small business owners typically attach this profit or loss schedule to their Form 1040 tax return when filing their taxes.

What is Schedule C on IRS form?

Use Schedule C (Form 1040) to report income or loss from a business you operated or a profession you practiced as a sole proprietor. An activity qualifies as a business if: Your primary purpose for engaging in the activity is for income or profit. You are involved in the activity with continuity and regularity.

Do I have to have a business to file Schedule C?

File Schedule C if you have to report business-related expenses and income as part of your annual tax return if you are self-employed, run a business as a sole proprietor, or have a single-member LLC that isn't treated as a corporation.

How do I fill out a Schedule C tax form?

Steps To Completing Schedule C Step 1: Gather Information. Step 2: Calculate Gross Profit and Income. Step 3: Include Your Business Expenses. Step 4: Include Other Expenses and Information. Step 5: Calculate Your Net Income. If You Have a Business Loss.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my IRS Instructions 1040 Schedule C in Gmail?

pdfFiller’s add-on for Gmail enables you to create, edit, fill out and eSign your IRS Instructions 1040 Schedule C and any other documents you receive right in your inbox. Visit Google Workspace Marketplace and install pdfFiller for Gmail. Get rid of time-consuming steps and manage your documents and eSignatures effortlessly.

How can I send IRS Instructions 1040 Schedule C to be eSigned by others?

Once your IRS Instructions 1040 Schedule C is ready, you can securely share it with recipients and collect eSignatures in a few clicks with pdfFiller. You can send a PDF by email, text message, fax, USPS mail, or notarize it online - right from your account. Create an account now and try it yourself.

How do I edit IRS Instructions 1040 Schedule C on an Android device?

You can edit, sign, and distribute IRS Instructions 1040 Schedule C on your mobile device from anywhere using the pdfFiller mobile app for Android; all you need is an internet connection. Download the app and begin streamlining your document workflow from anywhere.

What is IRS Instructions 1040 Schedule C?

IRS Instructions 1040 Schedule C is a form used by self-employed individuals to report income and expenses from their business activity.

Who is required to file IRS Instructions 1040 Schedule C?

Individuals who are self-employed and need to report income and expenses from their business activities are required to file IRS Schedule C.

How to fill out IRS Instructions 1040 Schedule C?

To fill out Schedule C, report income received from business activities, list expenses related to running the business, calculate net profit or loss, and then transfer the results to your Form 1040.

What is the purpose of IRS Instructions 1040 Schedule C?

The purpose of Schedule C is to allow self-employed individuals to report their business income and deductions to accurately calculate their taxable income.

What information must be reported on IRS Instructions 1040 Schedule C?

On Schedule C, you must report gross receipts, expenses such as cost of goods sold, operating expenses, and any other deductions related to your business.

Fill out your IRS Instructions 1040 Schedule C online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

IRS Instructions 1040 Schedule C is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.