IRS 15111 2021 free printable template

Show details

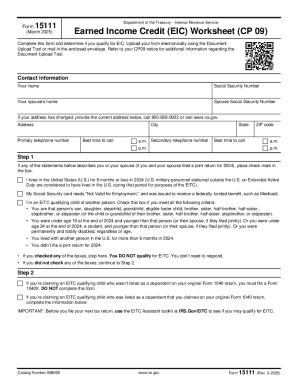

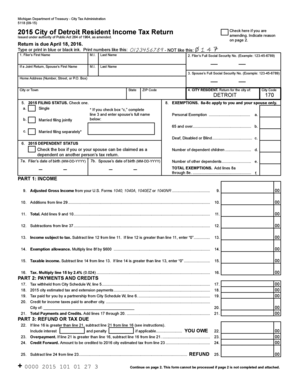

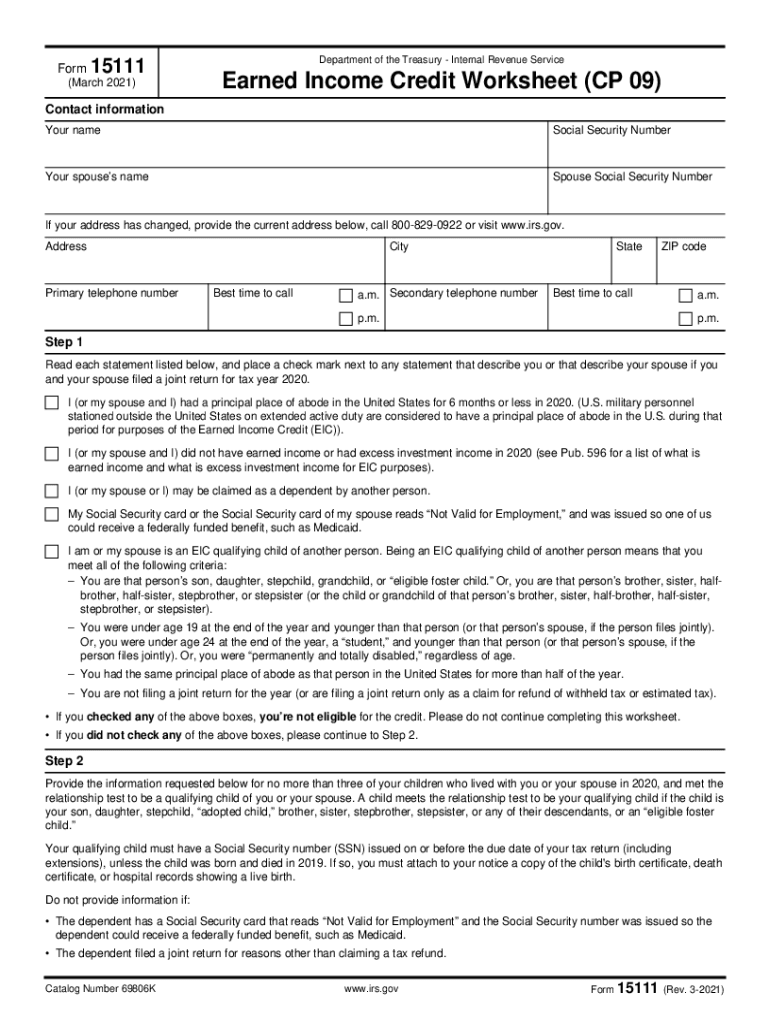

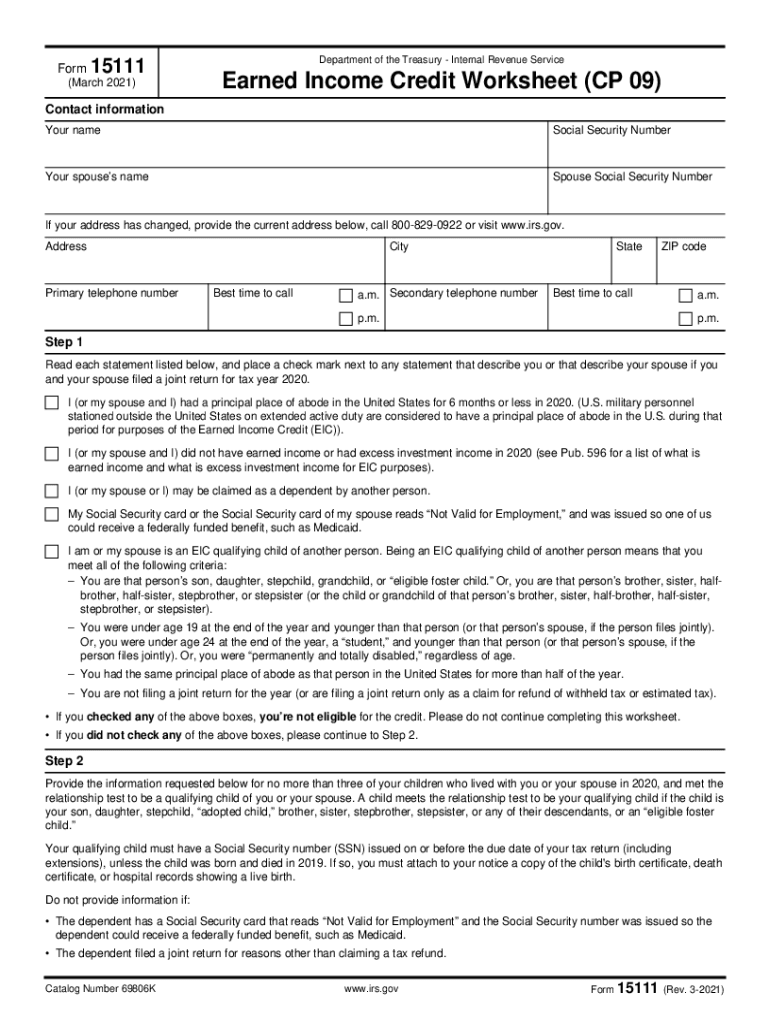

Form15111(March 2021)Department of the Treasury Internal Revenue ServiceEarned Income Credit Worksheet (CP 09)Contact information Your antisocial Security Numerous spouses espouse Social Security

pdfFiller is not affiliated with IRS

Get, Create, Make and Sign IRS 15111

Edit your IRS 15111 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your IRS 15111 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing IRS 15111 online

To use our professional PDF editor, follow these steps:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit IRS 15111. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

It's easier to work with documents with pdfFiller than you could have ever thought. Sign up for a free account to view.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

IRS 15111 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out IRS 15111

How to fill out IRS 15111

01

Download IRS Form 15111 from the IRS website.

02

Begin by entering your name, Social Security number, and address at the top of the form.

03

Indicate your filing status (e.g., single, married, etc.) in the designated section.

04

Provide details regarding the reason for filling out this form, including the specific tax year.

05

Follow the instructions for each section carefully and fill in the required information accordingly.

06

Make sure to review the form for accuracy and completeness before submitting it.

07

Submit the completed form as instructed, either by mail or electronically based on IRS guidelines.

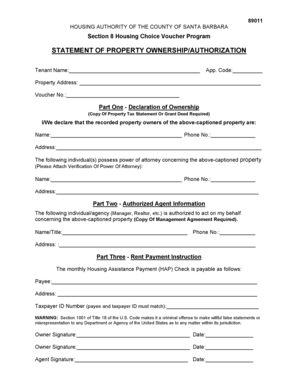

Who needs IRS 15111?

01

Individuals who have experienced economic hardship and wish to qualify for certain tax relief options.

02

Taxpayers who are seeking to claim a refund related to the Recovery Rebate Credit.

Fill

form

: Try Risk Free

People Also Ask about

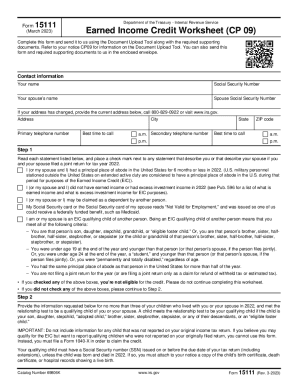

How long does Form 15111 take?

The IRS will use the information in Form 15111 along with the tax return to determine if the taxpayer qualifies for EIC and for how much and will mail a check to the taxpayer within 6 to 8 weeks. A Form 15111 fill-in PDF can be downloaded from the IRS website here.

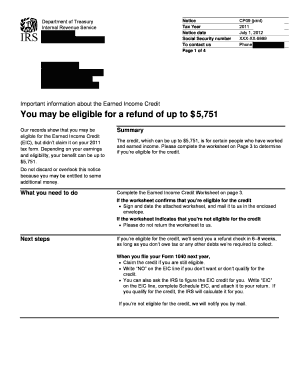

What qualifies you for earned income credit?

To qualify for the EITC, you must: Have worked and earned income under $59,187. Have investment income below $10,300 in the tax year 2022. Have a valid Social Security number by the due date of your 2022 return (including extensions)

Why did the IRS send me a Form 15111?

Form 15111 is a US Treasury Form that is a questionnaire of the dependents on your return to see if they qualify for EIC. This is an IRS Internal Form. They will expect you to complete and return the form.

How much earned income credit can a single person get?

Overview. You may be eligible for a California Earned Income Tax Credit (CalEITC) up to $3,417 for tax year 2022 as a working family or individual earning up to $30,000 per year.

What is considered earned income credit?

The Earned Income Tax Credit ( EITC ) is a tax credit that may give you money back at tax time or lower the federal taxes you owe. You can claim the credit whether you're single or married, or have children or not. The main requirement is that you must earn money from a job.

Why did I get a letter from IRS about earned income credit?

We sent you a letter (notice) because our records show you may be eligible for the EITC but didn't claim it on your tax return. First, find out if you qualify for EITC by following the steps shown in your notice. You can find out more about What You Need to Do and What we Will Do by using one of the links below.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I create an electronic signature for signing my IRS 15111 in Gmail?

You may quickly make your eSignature using pdfFiller and then eSign your IRS 15111 right from your mailbox using pdfFiller's Gmail add-on. Please keep in mind that in order to preserve your signatures and signed papers, you must first create an account.

How can I edit IRS 15111 on a smartphone?

You can do so easily with pdfFiller’s applications for iOS and Android devices, which can be found at the Apple Store and Google Play Store, respectively. Alternatively, you can get the app on our web page: https://edit-pdf-ios-android.pdffiller.com/. Install the application, log in, and start editing IRS 15111 right away.

How do I complete IRS 15111 on an iOS device?

pdfFiller has an iOS app that lets you fill out documents on your phone. A subscription to the service means you can make an account or log in to one you already have. As soon as the registration process is done, upload your IRS 15111. You can now use pdfFiller's more advanced features, like adding fillable fields and eSigning documents, as well as accessing them from any device, no matter where you are in the world.

What is IRS 15111?

IRS Form 15111 is a form used by taxpayers to request a determination regarding their eligibility for the claim of disallowed tax credits under certain programs.

Who is required to file IRS 15111?

Individuals or businesses that have been denied credit for specific tax credits and wish to appeal the decision are required to file IRS Form 15111.

How to fill out IRS 15111?

To fill out IRS Form 15111, taxpayers must provide their personal information, details about the tax credits claimed, reasons for the disallowance, and any supporting documentation as specified on the form.

What is the purpose of IRS 15111?

The purpose of IRS Form 15111 is to allow taxpayers to formally request a review and potential reversal of the disallowance of tax credits they believe they are entitled to.

What information must be reported on IRS 15111?

The form requires the taxpayer's identification information, details regarding the disallowed credit, specifics on the claim being made, and any relevant supporting documentation.

Fill out your IRS 15111 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

IRS 15111 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.