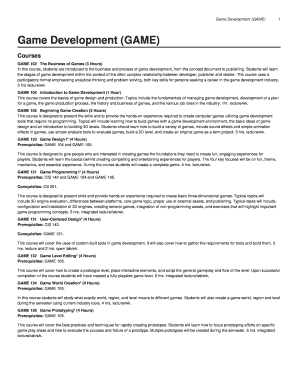

NY DTF IT-204-LL 2020-2026 free printable template

Show details

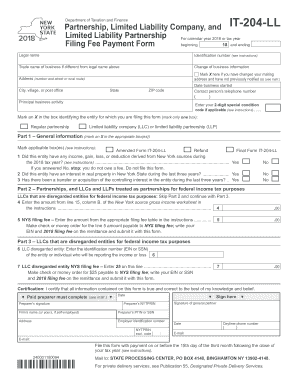

Mark an X in the box identifying the entity for which you are filing this form mark only one box Regular partnership Part 1 General information mark an X in the appropriate box es Mark applicable box es see instructions Amended Form IT-204-LL Refund Final Form IT-204-LL 1 Did this entity have any income gain loss or deduction derived from New York sources during the 2020 tax year see instructions. Partnership Limited Liability Company and IT-204-LL Limited Liability Partnership For calendar...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign pdffiller form

Edit your it 204 ll form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your it 204 ll pdf form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing ny 204ll limited create online

Follow the guidelines below to benefit from the PDF editor's expertise:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit it 204 ll form. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

With pdfFiller, dealing with documents is always straightforward.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

NY DTF IT-204-LL Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out ny it 204 form

How to fill out NY DTF IT-204-LL

01

Begin by downloading the NY DTF IT-204-LL form from the New York State Department of Taxation and Finance website.

02

Enter your business's name, address, and employer identification number (EIN) in the appropriate fields.

03

Indicate your business entity type, such as partnership or LLC.

04

Fill out the section for the tax year you are reporting on.

05

Provide details regarding your income and deductions, referring to your financial statements as needed.

06

If applicable, calculate any credits you are claiming, ensuring you have supporting documentation.

07

Review all entries for accuracy and completeness.

08

Sign and date the form where indicated.

09

Submit the completed form by the due date either by mail or electronically, as permitted.

Who needs NY DTF IT-204-LL?

01

The NY DTF IT-204-LL form is necessary for partnerships and limited liability companies (LLCs) that are required to file an annual tax return in New York State.

02

Any entity that has a filing requirement for New York State income tax and meets the threshold requirements for filing must complete this form.

Fill

new york it204 ll company form

: Try Risk Free

People Also Ask about form it 204 ll

What is NY 204 LL?

Form IT-204-LL, Partnership, Limited Liability Company, and Limited. Liability Partnership Filing Fee Payment Form, must be filed by. every: • limited liability company (LLC) that is a disregarded entity for. federal income tax purposes that has income, gain, loss, or.

Do disregarded entities file tax returns?

Does a Disregarded Entity Have to File Tax Returns? Since the owner pays the disregarded entity's federal taxes on their personal return, the disregarded entity is not required to file a federal income tax return.

Who must file it 204?

Any partnership that carries on or liquidates any trade, business, profession or occupation wholly or partly within New York City and has a total gross income from all business regardless of where carried on of more than $25,000 (prior to any deduction for cost of goods sold or services performed) must file an

What is an IT 204?

New York mandates that you electronically file Form IT-204-LL, Limited Liability Company, Filing Fee Payment Form.

Who must file NYC 204?

Any partnership that carries on or liquidates any trade, business, profession or occupation wholly or partly within New York City and has a total gross income from all business regardless of where carried on of more than $25,000 (prior to any deduction for cost of goods sold or services performed) must file an

What is the IT 204 IP code?

The Form IT-204-IP provided to you by your partnership lists your distributive share of any credits, credit components, credit factors, recapture of credits, and any other information reported by the partnership during the tax year. You need this information when completing your individual income tax return.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send nys it 204 ll for eSignature?

Once your NY DTF IT-204-LL is ready, you can securely share it with recipients and collect eSignatures in a few clicks with pdfFiller. You can send a PDF by email, text message, fax, USPS mail, or notarize it online - right from your account. Create an account now and try it yourself.

Can I create an electronic signature for signing my NY DTF IT-204-LL in Gmail?

Use pdfFiller's Gmail add-on to upload, type, or draw a signature. Your NY DTF IT-204-LL and other papers may be signed using pdfFiller. Register for a free account to preserve signed papers and signatures.

How can I edit NY DTF IT-204-LL on a smartphone?

The best way to make changes to documents on a mobile device is to use pdfFiller's apps for iOS and Android. You may get them from the Apple Store and Google Play. Learn more about the apps here. To start editing NY DTF IT-204-LL, you need to install and log in to the app.

What is NY DTF IT-204-LL?

NY DTF IT-204-LL is a tax form used by New York State limited liability companies (LLCs) to report their business income and pay the state's annual filing fee.

Who is required to file NY DTF IT-204-LL?

All limited liability companies (LLCs) formed in New York or doing business in New York are required to file NY DTF IT-204-LL, regardless of income.

How to fill out NY DTF IT-204-LL?

To fill out NY DTF IT-204-LL, start by providing your business's name, address, and Employer Identification Number (EIN). Then, report your total revenue and expenses, and calculate the fee based on your income bracket.

What is the purpose of NY DTF IT-204-LL?

The purpose of NY DTF IT-204-LL is to report income from LLC operations to the New York State Department of Taxation and Finance and to pay the required annual filing fee.

What information must be reported on NY DTF IT-204-LL?

The information that must be reported on NY DTF IT-204-LL includes the business's name, address, EIN, total income, total expenses, and the calculated filing fee based on the business's income level.

Fill out your NY DTF IT-204-LL online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

NY DTF IT-204-LL is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.