Canada GST/HST Return Working Copy 2021-2025 free printable template

Fill out, sign, and share forms from a single PDF platform

Edit and sign in one place

Create professional forms

Simplify data collection

Manage forms centrally

Why pdfFiller is the best tool for your documents and forms

End-to-end document management

Accessible from anywhere

Secure and compliant

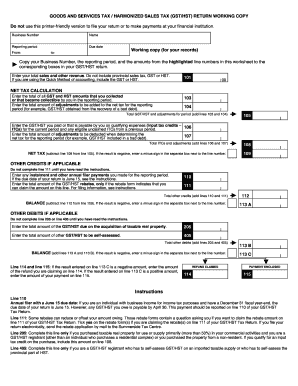

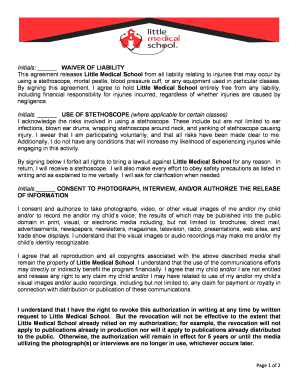

Understanding the Canada GST/HST Return Working Form

What is the Canada GST/HST return working form?

The Canada GST/HST return working form is a crucial document used for reporting Goods and Services Tax (GST) and Harmonized Sales Tax (HST) collected by businesses in Canada. This working copy serves as a preparatory tool to help individuals and companies calculate their net tax and ensure accurate reporting before submitting the official GST/HST return.

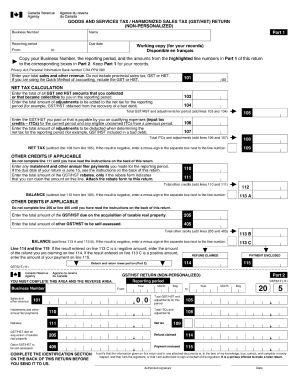

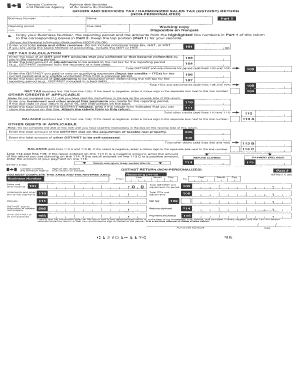

Key features of the Canada GST/HST return working form

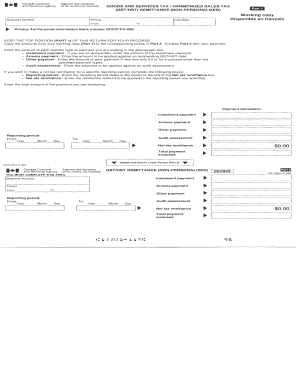

This form includes several key features designed to facilitate the preparation of your GST/HST return. It specifies sections for total sales and revenue, net tax calculations, adjustments for bad debts, and input tax credits (ITCs). Additionally, it clearly delineates reporting periods and due dates, providing an organized framework for collecting and analyzing financial data.

How to fill the Canada GST/HST return working form

Filling out the form requires careful attention to detail. Begin by entering your business number and the reporting period. Next, list total sales without including any provincial sales tax. Proceed to calculate the net tax based on GST and HST collected during the reporting period, and include any relevant adjustments. Ensure that you document input tax credits and account for any special circumstances affecting your calculations.

Best practices for accurate completion

To ensure accuracy when completing the Canada GST/HST return working form, consider the following best practices: consistently double-check figures; utilize accounting software for calculations; maintain organized records of sales and purchases; and familiarize yourself with the form's instructions. Additionally, consulting with a tax professional can provide valuable insights and help prevent errors.

Common errors and troubleshooting

Common mistakes when filling out the Canada GST/HST return working form include incorrect business numbers, miscalculations in net tax, and failure to account for all sales and adjustments. To troubleshoot these issues, review each section carefully, confirm that all figures align with supporting documentation, and consult the form’s guidelines for specific reporting requirements.

Frequently Asked Questions about gst34 printable form

Who needs to complete the Canada GST/HST return working form?

Businesses and self-employed individuals registered for GST/HST in Canada are required to complete this form to report sales, taxes collected, and any eligible credits.

What are input tax credits (ITCs)?

ITCs are credits that businesses can claim for the GST/HST paid on business-related purchases. These credits reduce the amount of net tax owed.

When is the Canada GST/HST return due?

The due date for submitting the GST/HST return typically falls one month after the end of the reporting period, but it's essential to verify specific deadlines based on your reporting frequency.

pdfFiller scores top ratings on review platforms