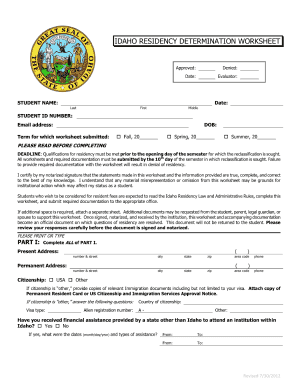

IRS 1040 - Schedule 2 2022 free printable template

Show details

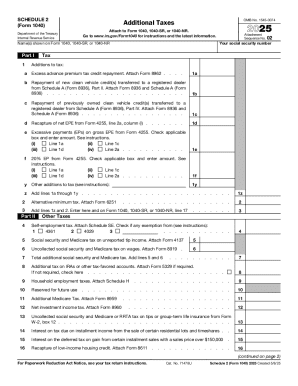

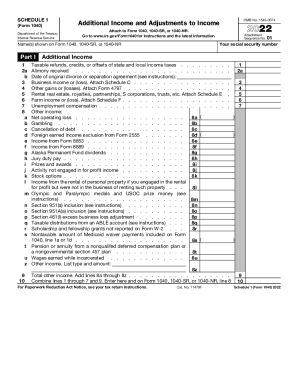

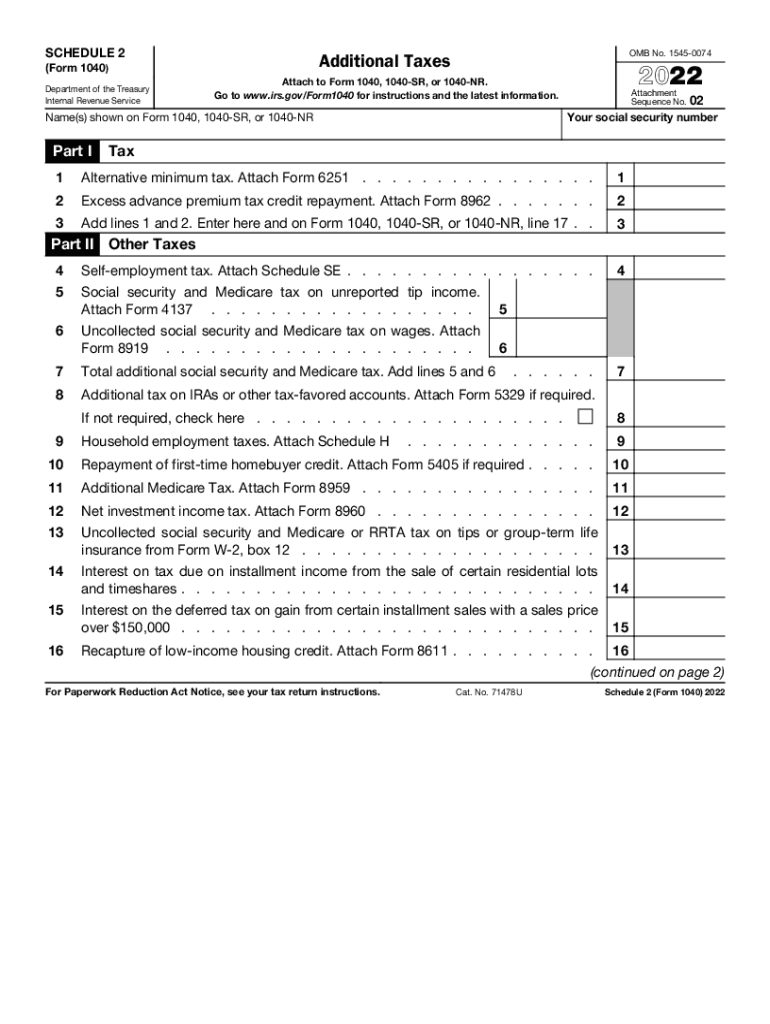

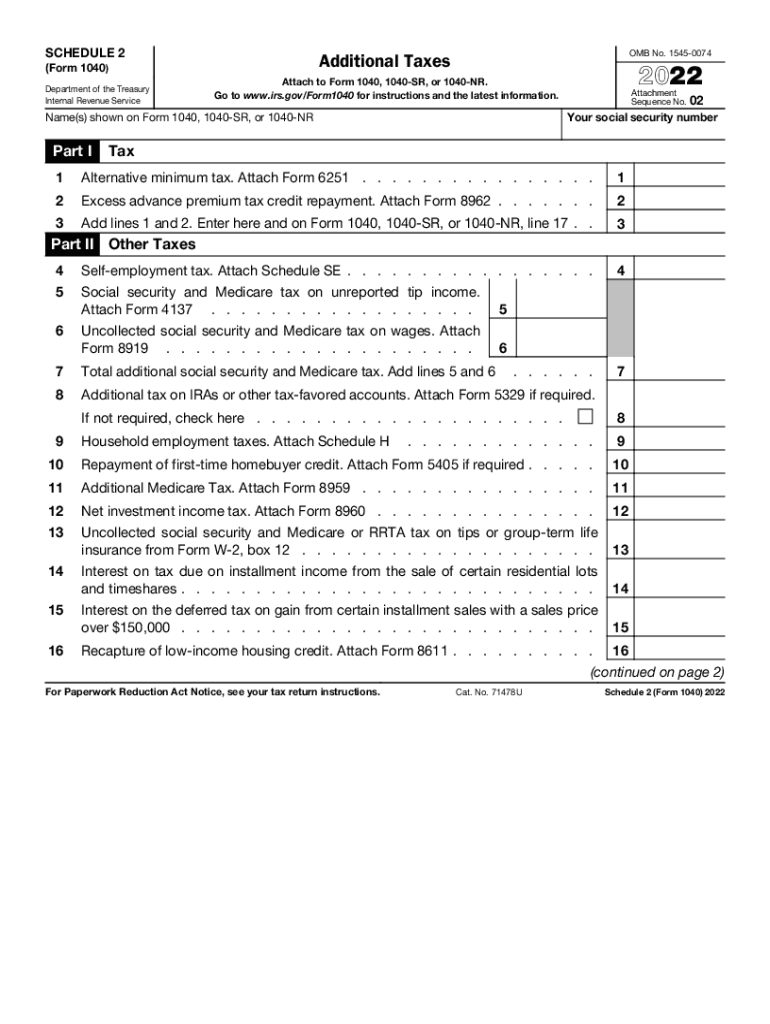

SCHEDULE 2 Department of the Treasury Internal Revenue Service OMB No. 15450074Additional Taxes(Form 1040)Attachment Sequence No. 02Your social security cumbersome(s) shown on Form 1040, 1040SR, or

pdfFiller is not affiliated with IRS

Get, Create, Make and Sign IRS 1040 - Schedule 2

Edit your IRS 1040 - Schedule 2 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your IRS 1040 - Schedule 2 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing IRS 1040 - Schedule 2 online

Use the instructions below to start using our professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit IRS 1040 - Schedule 2. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

With pdfFiller, it's always easy to work with documents. Try it!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

IRS 1040 - Schedule 2 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out IRS 1040 - Schedule 2

How to fill out IRS 1040 - Schedule 2

01

Obtain IRS Form 1040 and Schedule 2 from the official IRS website or a tax preparation software.

02

Enter your personal information at the top of Form 1040, including your name, address, and Social Security number.

03

Locate the section on Form 1040 where Schedule 2 needs to be referenced, generally in the 'Additional Taxes' section.

04

Fill out Schedule 2 by reporting any additional taxes owed, such as Alternative Minimum Tax or excess advance premium tax credits.

05

Ensure the calculations on Schedule 2 are accurate and sum them up appropriately to report on Form 1040.

06

Transfer the total additional taxes from Schedule 2 to the appropriate line on your Form 1040.

07

Review both forms for accuracy before submission.

08

Sign and date your Form 1040 and prepare it for filing, either electronically or by mail.

Who needs IRS 1040 - Schedule 2?

01

Anyone who owes additional taxes beyond the standard calculations on their Form 1040, including but not limited to self-employed individuals, those with certain types of income that trigger additional taxes, or taxpayers subject to the alternative minimum tax.

Fill

form

: Try Risk Free

People Also Ask about

What happens if you don't have a Schedule 2?

Schedule 2 is where other taxes are listed. If there is no Schedule 2, you subtract zero.

What does Schedule 2 mean IRS?

Schedule 2 (Form 1040), Additional Taxes Owe other taxes, such as self-employment tax, household employment taxes, additional tax on IRAs or other qualified retirement plans and tax-favored accounts, AMT, or need to make an excess advance premium tax credit repayment.

Is Schedule 2 a Schedule C?

Schedule C is not the same as a W-2. Schedule C reports income earned as a self-employed person either through a sole proprietorship or single-member LLC. W-2s report income you've earned as an employee of a business.

What is the schedule 2?

Examples of Schedule II narcotics include: hydromorphone (Dilaudid®), methadone (Dolophine®), meperidine (Demerol®), oxycodone (OxyContin®, Percocet®), and fentanyl (Sublimaze®, Duragesic®). Other Schedule II narcotics include: morphine, opium, codeine, and hydrocodone.

What is about Schedule 2?

Substances in this schedule have a high potential for abuse which may lead to severe psychological or physical dependence. Examples of Schedule II narcotics include: hydromorphone (Dilaudid®), methadone (Dolophine®), meperidine (Demerol®), oxycodone (OxyContin®, Percocet®), and fentanyl (Sublimaze®, Duragesic®).

Is it necessary to have a Schedule 1?

Not everyone needs to attach Schedule 1 to their federal income tax return. The IRS trimmed down and simplified the old Form 1040, allowing people to add on forms as needed. You only need to file Schedule 1 if you have any of the additional types of income or adjustments to income mentioned above.

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my IRS 1040 - Schedule 2 directly from Gmail?

pdfFiller’s add-on for Gmail enables you to create, edit, fill out and eSign your IRS 1040 - Schedule 2 and any other documents you receive right in your inbox. Visit Google Workspace Marketplace and install pdfFiller for Gmail. Get rid of time-consuming steps and manage your documents and eSignatures effortlessly.

How can I send IRS 1040 - Schedule 2 for eSignature?

Once you are ready to share your IRS 1040 - Schedule 2, you can easily send it to others and get the eSigned document back just as quickly. Share your PDF by email, fax, text message, or USPS mail, or notarize it online. You can do all of this without ever leaving your account.

How do I fill out IRS 1040 - Schedule 2 using my mobile device?

You can quickly make and fill out legal forms with the help of the pdfFiller app on your phone. Complete and sign IRS 1040 - Schedule 2 and other documents on your mobile device using the application. If you want to learn more about how the PDF editor works, go to pdfFiller.com.

What is IRS 1040 - Schedule 2?

IRS 1040 - Schedule 2 is a form used by taxpayers to report additional taxes that are not reported directly on the main IRS Form 1040. This includes taxes related to self-employment, household employment, and other specific taxes.

Who is required to file IRS 1040 - Schedule 2?

Taxpayers who need to report additional taxes or who have specific tax situations, such as self-employment taxes or alternative minimum tax obligations, are required to file IRS 1040 - Schedule 2.

How to fill out IRS 1040 - Schedule 2?

To fill out IRS 1040 - Schedule 2, taxpayers should gather information about the additional taxes they need to report, complete the form by accurately entering the relevant amounts, and then transfer the total to their main Form 1040.

What is the purpose of IRS 1040 - Schedule 2?

The purpose of IRS 1040 - Schedule 2 is to allow taxpayers to report additional taxes that are not included on the main Form 1040, ensuring compliance with tax laws and accurate reporting of tax liabilities.

What information must be reported on IRS 1040 - Schedule 2?

IRS 1040 - Schedule 2 requires taxpayers to report various types of additional taxes, including self-employment tax, unreported social security and Medicare tax, and any alternative minimum tax. Specific lines correspond to different types of taxes that need to be accurately reported.

Fill out your IRS 1040 - Schedule 2 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

IRS 1040 - Schedule 2 is not the form you're looking for?Search for another form here.

Relevant keywords

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.