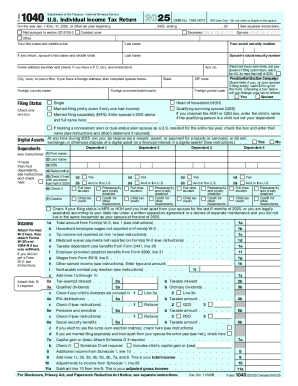

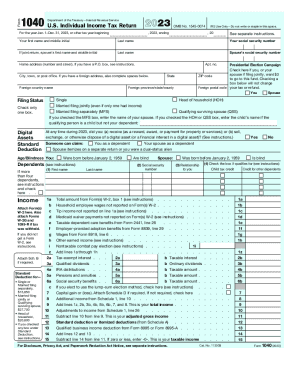

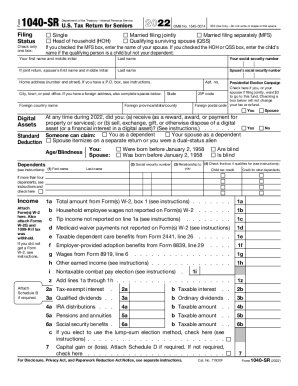

IRS 1040 2022 free printable template

Instructions and Help about IRS 1040

How to edit IRS 1040

How to fill out IRS 1040

About IRS previous version

What is IRS 1040?

Who needs the form?

Components of the form

What information do you need when you file the form?

Where do I send the form?

What is the purpose of this form?

When am I exempt from filling out this form?

What are the penalties for not issuing the form?

Is the form accompanied by other forms?

FAQ about IRS 1040

What should I do if I need to correct information on my filed IRS 1040?

If you discover an error on your filed IRS 1040, you will need to submit Form 1040-X to correct it. This process allows you to amend your return, addressing specific errors or changing your filing status. Make sure to include any necessary documentation and explain the changes you are making.

How can I track the status of my submitted IRS 1040?

To track the status of your submitted IRS 1040, you can visit the IRS 'Where’s My Refund?' tool on their website. You'll need to provide your Social Security number, filing status, and the exact refund amount to get updates on the processing of your return and any refunds due.

What should I do if my e-filed IRS 1040 is rejected?

If your e-filed IRS 1040 is rejected, the IRS will provide a rejection code that indicates the issue. Review the error message, make the necessary corrections, and resubmit your return. It’s crucial to address these issues promptly to avoid potential delays in processing.

What are the privacy and data security measures for filing IRS 1040 online?

When filing your IRS 1040 online, ensure the tax software you use has strong encryption protocols to protect your personal information. Additionally, be aware of the need to secure your internet connection and use reliable antivirus software to safeguard against cyber threats.

What fees may apply for e-filing the IRS 1040, and what happens if my submission is rejected?

While many platforms offer free e-filing for IRS 1040, some may charge service fees for premium features or complex returns. If your submission is rejected, you won’t typically incur additional fees, but you must promptly rectify the errors to ensure timely processing of your amended return.

See what our users say