Berklee College of Music Parent Non-Tax Filer Form 2011-2025 free printable template

Show details

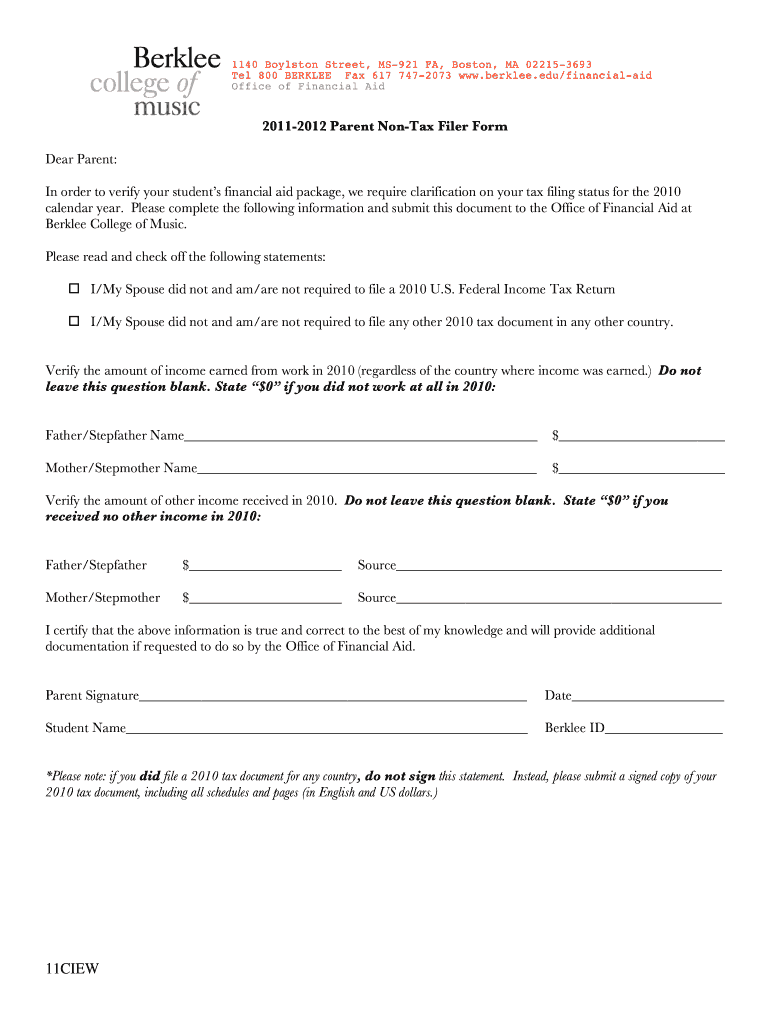

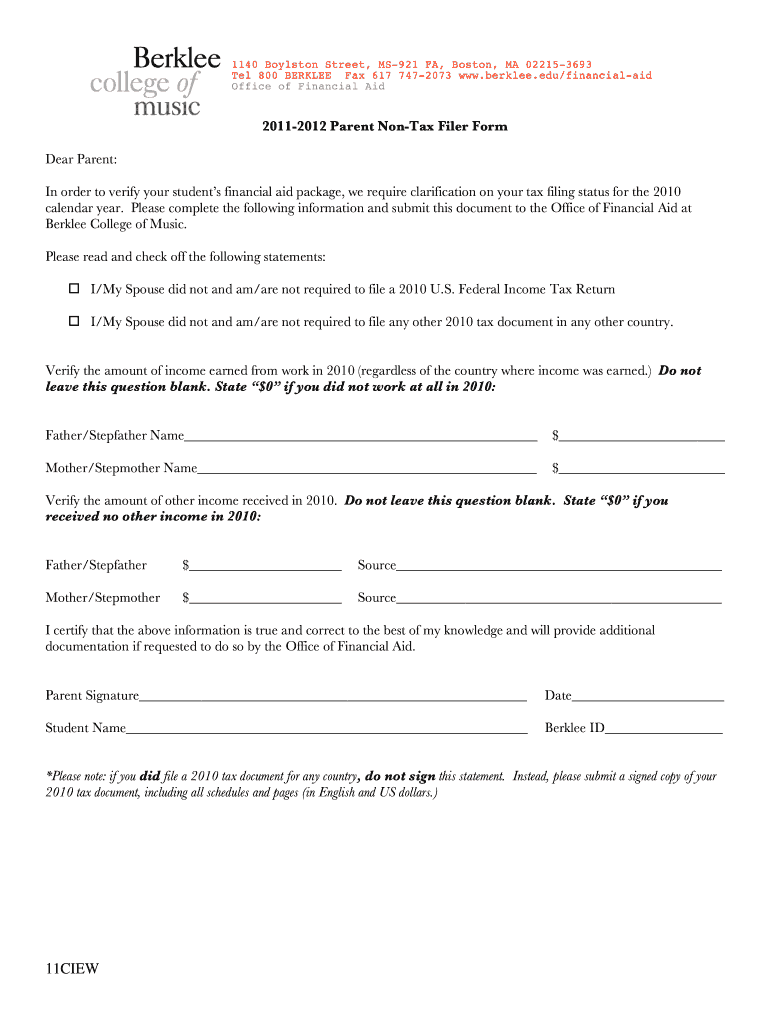

1140 Boston Street, MS-921 FA, Boston, MA 02215-3693 Tel 800 BERKLEY Fax 617 747-2073 www.berklee.edu/financial-aid Office of Financial Aid 2011-2012 Parent Non-Tax Filer Form Dear Parent: In order

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign Berklee College of Music Parent Non-Tax Filer

Edit your Berklee College of Music Parent Non-Tax Filer form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your Berklee College of Music Parent Non-Tax Filer form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing Berklee College of Music Parent Non-Tax Filer online

To use the professional PDF editor, follow these steps:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit Berklee College of Music Parent Non-Tax Filer. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

With pdfFiller, dealing with documents is always straightforward.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out Berklee College of Music Parent Non-Tax Filer

How to fill out Berklee College of Music Parent Non-Tax Filer Form

01

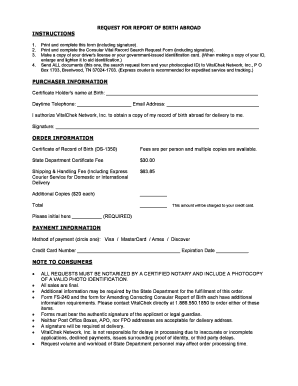

Obtain the Berklee College of Music Parent Non-Tax Filer Form from the school's financial aid website.

02

Read the instructions provided on the form carefully.

03

Fill out the parent's personal information, including name, address, and social security number.

04

Indicate the number of people in the household, including the parent and any dependents.

05

Provide any additional income sources, such as unemployment benefits or government assistance, if applicable.

06

Sign and date the form to certify that the information provided is accurate.

07

Submit the completed form through the online financial aid portal or via mail to the school's financial aid office.

Who needs Berklee College of Music Parent Non-Tax Filer Form?

01

Parents of students who are applying for financial aid and who do not have a tax return for the previous year.

02

Parents who have had a significant change in income or employment status and require assistance in demonstrating financial need.

Fill

form

: Try Risk Free

People Also Ask about

What is the tax form called in Canada?

T1. A T1 is used by Canadian taxpayers to file personal income tax returns. Income source examples in which you would use this form include: Employment income.

How to fill out TD1 2022?

0:02 12:26 Page you need to put in your name first and last your date of birth. Your address including postalMorePage you need to put in your name first and last your date of birth. Your address including postal code. And your social insurance.

What is a T1 vs T4?

The T1 is a form filled out by employees and business owners, then submitted to the CRA. The T4 form, on the other hand, is filled out by employers and distributed to employees. The 2 forms provide similar information but have entirely different purposes.

How do I get my TD1 form?

Notice for employers give them the link to this webpage. Ask them to fill out the form and then scan it and send it to you online or give you a printed copy. create federal and provincial or territorial Forms TD1, following the instructions at Electronic Form TD1, and have your employees send them to you online.

How do I view TD1?

The federal and provincial/territorial TD1 Personal Tax Credits Return forms can be found on the CRA website.

How do I file my taxes for the first time?

How to File Your Taxes for the First Time Determine whether you're required to file. See if you qualify for tax deductions or credits. Gather your documentation. Get help. Safeguard against identity theft. Double check your return. File your tax return. Use direct deposit if you're due a refund.

Can you do your own taxes without an accountant?

If you're self-employed, you don't necessarily need an accountant to do your taxes. Many software programs make it possible to file self-employed taxes yourself.

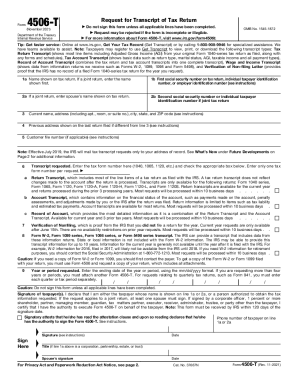

How do I file my w2 tax return?

When filing electronically: You must provide a copy of your Forms W-2 to the authorized IRS e-file provider before the provider sends the electronic return to the IRS. You don't need to send your Forms W-2 to the IRS and should keep them in a safe place with a copy of your tax return.

What is the program that the CRA uses to process your taxes?

NETFILE is an electronic tax-filing service that lets you do your personal taxes online and send your income tax and benefit return directly to the Canada Revenue Agency (CRA).

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make edits in Berklee College of Music Parent Non-Tax Filer without leaving Chrome?

Add pdfFiller Google Chrome Extension to your web browser to start editing Berklee College of Music Parent Non-Tax Filer and other documents directly from a Google search page. The service allows you to make changes in your documents when viewing them in Chrome. Create fillable documents and edit existing PDFs from any internet-connected device with pdfFiller.

Can I create an eSignature for the Berklee College of Music Parent Non-Tax Filer in Gmail?

It's easy to make your eSignature with pdfFiller, and then you can sign your Berklee College of Music Parent Non-Tax Filer right from your Gmail inbox with the help of pdfFiller's add-on for Gmail. This is a very important point: You must sign up for an account so that you can save your signatures and signed documents.

How can I fill out Berklee College of Music Parent Non-Tax Filer on an iOS device?

Install the pdfFiller app on your iOS device to fill out papers. If you have a subscription to the service, create an account or log in to an existing one. After completing the registration process, upload your Berklee College of Music Parent Non-Tax Filer. You may now use pdfFiller's advanced features, such as adding fillable fields and eSigning documents, and accessing them from any device, wherever you are.

What is Berklee College of Music Parent Non-Tax Filer Form?

The Berklee College of Music Parent Non-Tax Filer Form is a document that allows parents who do not file federal taxes to provide financial information necessary for student aid applications.

Who is required to file Berklee College of Music Parent Non-Tax Filer Form?

Parents who have income but do not meet the income threshold for filing federal taxes are required to file the Berklee College of Music Parent Non-Tax Filer Form.

How to fill out Berklee College of Music Parent Non-Tax Filer Form?

To fill out the form, parents need to provide details about their income, sources of income, and any relevant financial circumstances, ensuring that the information is accurate and complete.

What is the purpose of Berklee College of Music Parent Non-Tax Filer Form?

The purpose of the form is to collect financial information from parents who do not file taxes, ensuring that students can access financial aid and support services based on their family's financial situation.

What information must be reported on Berklee College of Music Parent Non-Tax Filer Form?

The information that must be reported includes total income earned, the sources of that income, household size, and any other relevant financial details that would assist in determining financial aid eligibility.

Fill out your Berklee College of Music Parent Non-Tax Filer online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Berklee College Of Music Parent Non-Tax Filer is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.