Canada RC66SCH 2023-2025 free printable template

Show details

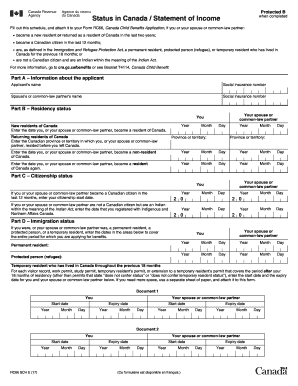

Ce formulaire est utilisé pour déterminer l'admissibilité aux prestations et crédits pour enfants et familles au Canada. Les candidats fournissent des informations sur leur statut de résidence,

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign rc66sch form

Edit your rc66sch status form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your rc66sch form download form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit rc66sch form pdf online

In order to make advantage of the professional PDF editor, follow these steps:

1

Log into your account. In case you're new, it's time to start your free trial.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit form rc66sch. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

With pdfFiller, it's always easy to work with documents. Try it out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

Canada RC66SCH Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out rc66sch fill form

How to fill out Canada RC66SCH

01

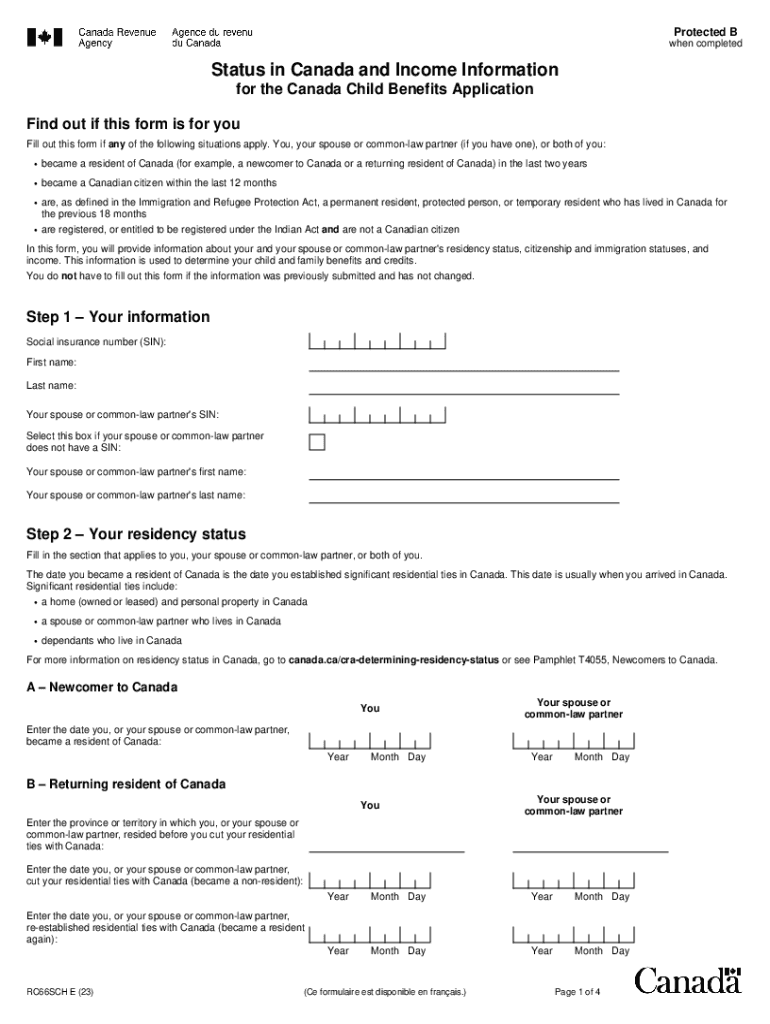

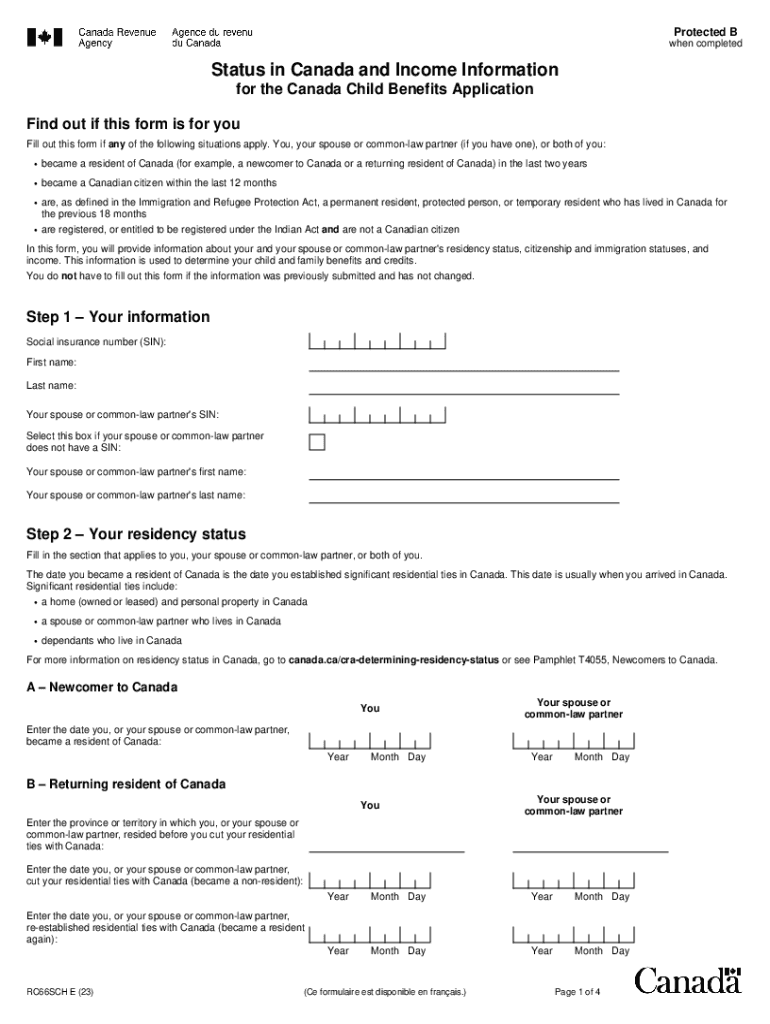

Start by gathering required personal information, including your Social Insurance Number and postal code.

02

Indicate your marital status (single, married, or common-law) in the appropriate section.

03

Provide details for any dependents, including their names, birth dates, and relationship to you.

04

Fill in your income information accurately as requested in the form.

05

Sign and date the application at the end to certify the information provided.

Who needs Canada RC66SCH?

01

Individuals or families applying for the Canada Child Benefit (CCB) need to fill out the RC66SCH form.

02

Parents or guardians who wish to register their children for CCB also need this form.

Fill

rc66sch application

: Try Risk Free

People Also Ask about rc66sch status in canada statement of income

Can I get child tax credit if I live abroad?

What about the child care/dependent tax credit requirements? Yes, expats are also able to claim this credit for a qualifying child or dependent. The normal child care tax credit requirements apply even if you're abroad.

How do I check my Canadian child tax benefit?

You can check the status of your benefits by logging into your CRA My Account. Contact the CRA if debt repayment causes you financial hardship. Call 1-888-863-8662 for benefit debt or, 1-888-863-8657 for tax return debt. Learn more at Canada.ca/balance-owing.

What is the BC child Opportunity benefit?

If your adjusted family net income for the 2021 taxation year is $82,578 or more, the maximum benefit you can receive is: $108.33 per month for your first child. $106.67 per month for your second child. $105 per month for each additional child.

What is RC66SCH status in Canada?

What is the RC66SCH form? When you file your income tax you may use form RC66SCH to state your status in Canada if you are a new Canadian citizen, became a resident in the last 2 years, or a permanent resident, and you want to apply for the Canada Child Benefit (CCB).

What is the 183-day rule in Canada?

If you sojourned in Canada for 183 days or more (the 183-day rule) in the tax year, do not have significant residential ties with Canada, and are not considered a resident of another country under the terms of a tax treaty between Canada and that country, see Deemed residents of Canada for the rules that apply to you.

Can I get child benefit if I live abroad Canada?

If you are eligible to receive the Canada child benefit (CCB), you will continue to receive it and any related provincial or territorial benefits that you are eligible for during your absence from Canada. However, you will have to file a return each year so that the CRA can calculate your CCB .

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get rc66 form?

The premium pdfFiller subscription gives you access to over 25M fillable templates that you can download, fill out, print, and sign. The library has state-specific rc66sch status in canada statement of income form and other forms. Find the template you need and change it using powerful tools.

Can I create an electronic signature for the canada rc66sch in Chrome?

As a PDF editor and form builder, pdfFiller has a lot of features. It also has a powerful e-signature tool that you can add to your Chrome browser. With our extension, you can type, draw, or take a picture of your signature with your webcam to make your legally-binding eSignature. Choose how you want to sign your rc66sch download and you'll be done in minutes.

Can I create an eSignature for the child benefit application form in Gmail?

With pdfFiller's add-on, you may upload, type, or draw a signature in Gmail. You can eSign your formulaire rc66sch and other papers directly in your mailbox with pdfFiller. To preserve signed papers and your personal signatures, create an account.

What is Canada RC66SCH?

Canada RC66SCH is a form used by the Canada Revenue Agency (CRA) to apply for the Canada Child Benefit (CCB) for families with children.

Who is required to file Canada RC66SCH?

Parents or guardians who are applying for the Canada Child Benefit for their children must file Canada RC66SCH.

How to fill out Canada RC66SCH?

To fill out Canada RC66SCH, you need to provide personal information about yourself, your spouse or common-law partner, and your children, including their dates of birth and any relevant income details.

What is the purpose of Canada RC66SCH?

The purpose of Canada RC66SCH is to determine eligibility for the Canada Child Benefit and to calculate the amount of benefit families will receive.

What information must be reported on Canada RC66SCH?

Information that must be reported on Canada RC66SCH includes personal identification, marital status, children's details, and income information of the applicant and their spouse or common-law partner.

Fill out your Canada RC66SCH online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Pdffiller is not the form you're looking for?Search for another form here.

Keywords relevant to canada rc66sch

Related to child benefits form

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.