IRS 656 2012 free printable template

Show details

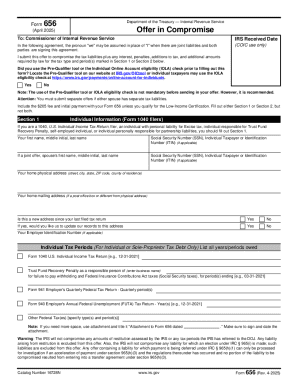

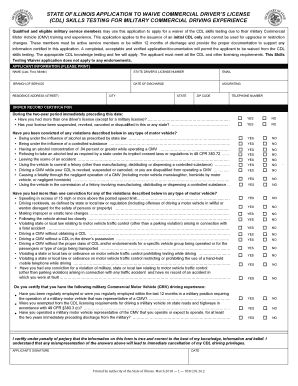

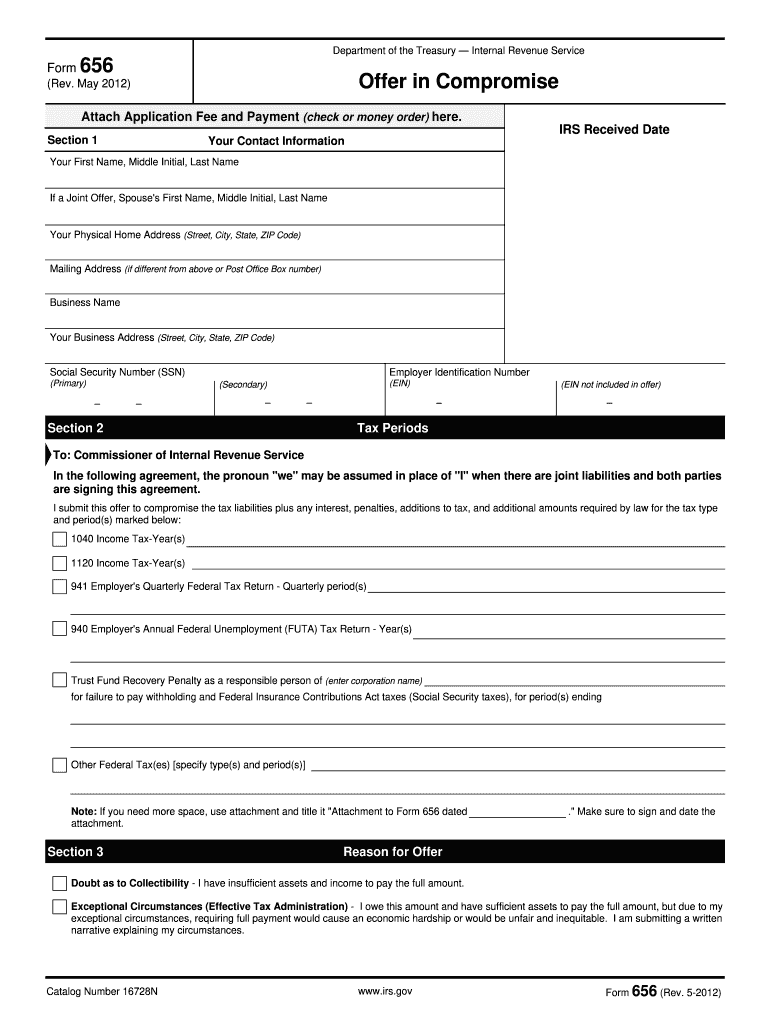

Paid on the day month s after acceptance. Periodic Payment is being submitted with the Form 656 and then on the total of day of each month thereafter for a months may not exceed 23. Total payments must equal the total Offer Amount. You must continue to make these monthly payments while the IRS is considering the offer. Catalog Number 16728N www.irs.gov Form 656 Rev. 5-2012 Page 2 of 4 Section 3 Continued Explanation of Circumstances Add additional pages if needed The IRS understands that there...are unplanned events or special circumstances such as serious illness where paying the full amount or the minimum offer amount might impair your ability to provide for yourself and your family. Our authority to request this information is Section 7801 of the Internal Revenue Code. Our purpose for requesting the information is to determine if it is in the best interests of the IRS to accept an offer. You are not required to make an offer however if you choose to do so you must provide all of the...taxpayer information requested. Failure to provide all of the information may prevent us from processing your request. If you are a paid preparer and you prepared the Form 656 for the taxpayer submitting an offer we request that you complete and sign Section 10 on Form 656 and provide identifying information. Providing this information is voluntary. Section 1 IRS Received Date Your Contact Information Your First Name Middle Initial Last Name If a Joint Offer Spouse s First Name Middle Initial...Last Name Your Physical Home Address Street City State ZIP Code Mailing Address if different from above or Post Office Box number Business Name Your Business Address Street City State ZIP Code Social Security Number SSN Primary Employer Identification Number EIN Secondary EIN not included in offer Tax Periods To Commissioner of Internal Revenue Service In the following agreement the pronoun we may be assumed in place of I when there are joint liabilities and both parties are signing this...agreement. I submit this offer to compromise the tax liabilities plus any interest penalties additions to tax and additional amounts required by law for the tax type and period s marked below 1040 Income Tax-Year s 941 Employer s Quarterly Federal Tax Return - Quarterly period s 940 Employer s Annual Federal Unemployment FUTA Tax Return - Year s Trust Fund Recovery Penalty as a responsible person of enter corporation name for failure to pay withholding and Federal Insurance Contributions Act...taxes Social Security taxes for period s ending Other Federal Tax es specify type s and period s Note If you need more space use attachment and title it Attachment to Form 656 dated attachment. Make checks payable to the United States Treasury and attach to the front of your Form 656 Offer in Compromise. If you are a paid preparer and you prepared the Form 656 for the taxpayer submitting an offer we request that you complete and sign Section 10 on Form 656 and provide identifying information....Providing this information is voluntary. This information will be used to administer and enforce the internal revenue laws of the United States and may be used to regulate practice before the Internal Revenue Service for those persons subject to Treasury Department Circular No. 230 Regulations Governing the Practice of Attorneys Certified Public Accountants Enrolled Agents Enrolled Actuaries and Appraisers before the Internal Revenue Service. Your offer must be fully paid 24 months from the date...your offer is accepted. Total Offer Amount - 20 Initial Payment Remaining Balance You may pay the remaining balance in one payment after acceptance of the offer or up to five payments. paid on the day month s after acceptance. Periodic Payment is being submitted with the Form 656 and then on the total of day of each month thereafter for a months may not exceed 23. I submit this offer to compromise the tax liabilities plus any interest penalties additions to tax and additional amounts required by...law for the tax type and period s marked below 1040 Income Tax-Year s 941 Employer s Quarterly Federal Tax Return - Quarterly period s 940 Employer s Annual Federal Unemployment FUTA Tax Return - Year s Trust Fund Recovery Penalty as a responsible person of enter corporation name for failure to pay withholding and Federal Insurance Contributions Act taxes Social Security taxes for period s ending Other Federal Tax es specify type s and period s Note If you need more space use attachment and...title it Attachment to Form 656 dated attachment. Make sure to sign and date the Reason for Offer Doubt as to Collectibility - I have insufficient assets and income to pay the full amount.

pdfFiller is not affiliated with IRS

Instructions and Help about IRS 656

How to edit IRS 656

How to fill out IRS 656

Instructions and Help about IRS 656

How to edit IRS 656

Editing IRS Form 656 is crucial for ensuring accuracy before submission. Use form editing tools like pdfFiller to make necessary changes to your information. You can easily input or correct details directly within the form as needed. Review all entries carefully to avoid discrepancies that could affect your tax resolution process.

How to fill out IRS 656

Filling out IRS Form 656 requires careful attention to details. Gather all necessary information before you begin, including your personal details, financial data, and any documentation related to your tax situation. Follow these steps:

01

Start with your name, address, and Social Security number.

02

Include the tax period for which you are applying.

03

Detail your financial situation, including assets and liabilities.

Completing these sections accurately is essential for the IRS to assess your Offer in Compromise properly.

About IRS previous version

What is IRS 656?

IRS Form 656 is the official Application for Offer in Compromise. This form allows taxpayers with unpaid tax debts to propose a settlement for less than the full amount owed to the IRS. It is primarily aimed at those who cannot pay their tax liabilities due to financial hardship.

Who needs the form?

Taxpayers facing financial difficulties may need IRS Form 656. This includes individuals or businesses who owe back taxes and are unable to make full payments due to overwhelming financial burdens. Those considered eligible should evaluate if filing an Offer in Compromise is the best course of action for their circumstances.

Components of the form

IRS Form 656 consists of several key components, including sections for taxpayer information, a proposal for the offer, and a declaration of financial hardship. Each component must be completed accurately to support the Offer in Compromise request effectively. Essential details include:

01

Name and taxpayer identification number.

02

Amount offered to settle the tax debt.

03

Signature of the taxpayer or their representative.

What information do you need when you file the form?

When filing IRS Form 656, taxpayers need to gather comprehensive financial information, including:

01

List of assets, including real estate and personal property.

02

Details about income sources and monthly expenses.

03

Documentation to corroborate your financial situation, such as bank statements or pay stubs.

Having complete and accurate information will support your application and facilitate a smoother review process.

Where do I send the form?

Submit IRS Form 656 to the address specified in the form's instructions. The mailing address may vary based on your location and the type of tax liability. Ensure you double-check the submission address to avoid delays in processing your Offer in Compromise.

What is the purpose of this form?

The purpose of IRS Form 656 is to facilitate a negotiated settlement between the taxpayer and the IRS. By submitting this form, taxpayers can seek relief from their tax obligations based on their financial capabilities. This can ultimately help them avoid severe collection actions.

When am I exempt from filling out this form?

Taxpayers may be exempt from filling out IRS Form 656 if they do not owe taxes or if their tax debt is considered manageable. Additionally, individuals who are in bankruptcy proceedings need not submit this form. Understanding these exemptions can help taxpayers better navigate their tax responsibilities.

Due date

IRS Form 656 does not have a specific due date. However, it is crucial to submit the form as soon as possible if you are facing tax collection actions. Delays in submission may result in ongoing penalties or interest on the owed amount.

What are the penalties for not issuing the form?

Failure to submit IRS Form 656 when required may result in continued tax collection efforts by the IRS. This could lead to wage garnishments, bank levies, or liens against assets. Moreover, the absence of the form denies taxpayers the opportunity to resolve their debts through an Offer in Compromise.

Is the form accompanied by other forms?

IRS Form 656 is typically submitted alongside other forms, such as IRS Form 433-A or Form 433-B, which provide detailed financial statements. These accompanying forms are crucial for the IRS to assess your financial condition and the legitimacy of your Offer in Compromise.

See what our users say

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.