IN Form 11274 2023 free printable template

Show details

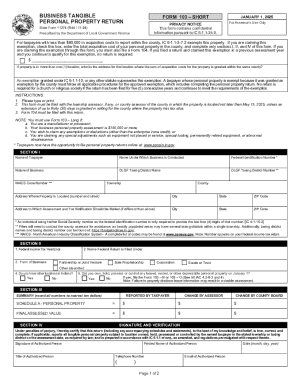

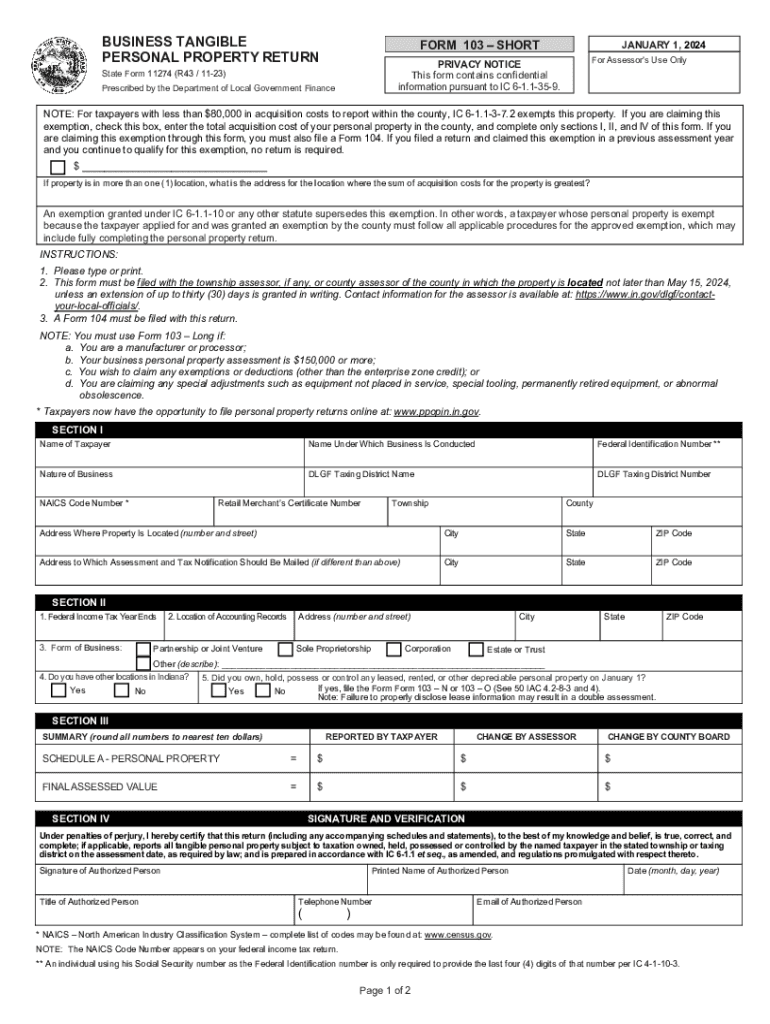

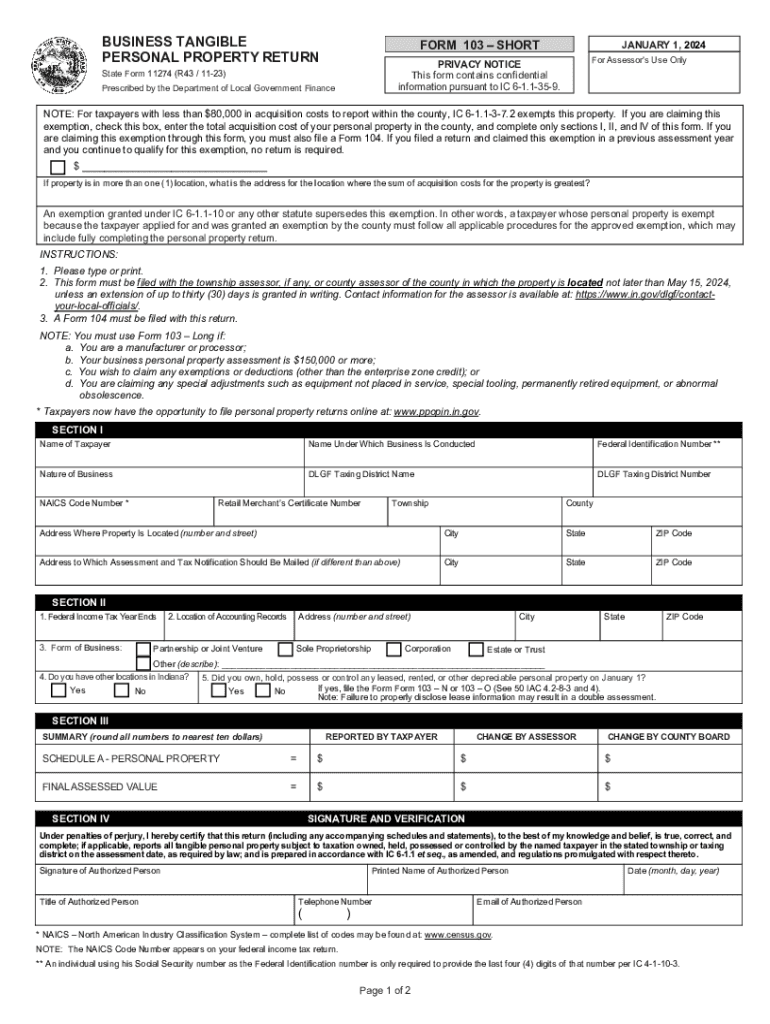

BUSINESS TANGIBLE PERSONAL PROPERTY RETURN FORM 103 – SHORT JANUARY 1, 2024 For Assessor\'s Use Only PRIVACY NOTICE This form contains confidential information pursuant to IC 6-1.1-35-9. State Form

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign IN Form 11274

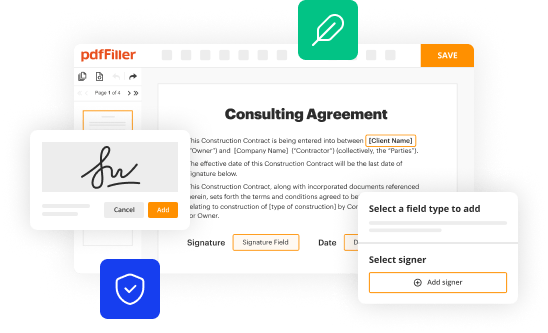

Edit your IN Form 11274 form online

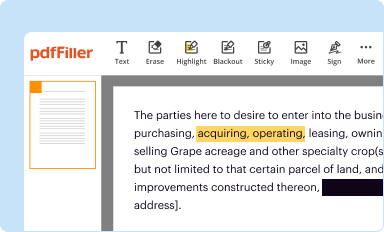

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

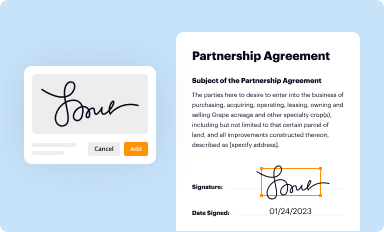

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your IN Form 11274 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing IN Form 11274 online

In order to make advantage of the professional PDF editor, follow these steps:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit IN Form 11274. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

With pdfFiller, it's always easy to deal with documents. Try it right now

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

IN Form 11274 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out IN Form 11274

How to fill out IN Form 11274

01

Obtain IN Form 11274 from the official immigration website or the appropriate office.

02

Read the instructions carefully to understand the purpose of the form.

03

Fill in your personal details accurately including your name, address, and contact information.

04

Provide any relevant information related to your immigration status or application.

05

Review all entries for accuracy and completeness.

06

Sign and date the form where indicated.

07

Submit the form along with any required supporting documents to the appropriate immigration office.

Who needs IN Form 11274?

01

Individuals applying for immigration benefits or status in the relevant jurisdiction.

02

Applicants seeking to update their immigration information.

03

People who are required to provide additional information as part of their immigration process.

Fill

form

: Try Risk Free

People Also Ask about

What is the difference between Schedule D and form 4797?

Whereas Schedule D forms are used to report personal gains, IRS Form 4797 is used to report profits from real estate transactions centered on business use. IRS Form 4797 has much more specific utilization, while Schedule D is a required form for anyone reporting personal gains in general.

What is the difference between Schedule D and Form 4797?

What Is the Difference Between Schedule D and Form 4797? Schedule D is used to report gains from personal investments, while Form 4797 is used to report gains from real estate dealings—those that are done primarily in relation to business rather than personal transactions.

What is form 8949 used for?

Use Form 8949 to report sales and exchanges of capital assets. Form 8949 allows you and the IRS to reconcile amounts that were reported to you and the IRS on Forms 1099-B or 1099-S (or substitute statements) with the amounts you report on your return.

What is a form 4797 used for?

Use Form 4797 to report: The sale or exchange of property. The involuntary conversion of property and capital assets. The disposition of noncapital assets.

Who has to fill out Form 4797?

If you sold property that was your home and you also used it for business, you may need to use Form 4797 to report the sale of the part used for business (or the sale of the entire property if used entirely for business). Gain or loss on the sale of the home may be a capital gain or loss or an ordinary gain or loss.

Should I use form 8949 or 4797?

Should You Use Form 8949 or Form 4797? When reporting gains from the sale of real estate, Form 4797 will suffice in most scenarios. Form 8949 will need to be used when deferring capital gains through investments in a qualified fund.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify IN Form 11274 without leaving Google Drive?

Simplify your document workflows and create fillable forms right in Google Drive by integrating pdfFiller with Google Docs. The integration will allow you to create, modify, and eSign documents, including IN Form 11274, without leaving Google Drive. Add pdfFiller’s functionalities to Google Drive and manage your paperwork more efficiently on any internet-connected device.

Where do I find IN Form 11274?

It's simple with pdfFiller, a full online document management tool. Access our huge online form collection (over 25M fillable forms are accessible) and find the IN Form 11274 in seconds. Open it immediately and begin modifying it with powerful editing options.

Can I edit IN Form 11274 on an Android device?

You can. With the pdfFiller Android app, you can edit, sign, and distribute IN Form 11274 from anywhere with an internet connection. Take use of the app's mobile capabilities.

What is IN Form 11274?

IN Form 11274 is a tax form used in India for reporting income and taxes related to specific assessments or claims, typically involving income tax.

Who is required to file IN Form 11274?

Entities or individuals who have specific income types or are claiming certain benefits or deductions as outlined by the tax authority are required to file IN Form 11274.

How to fill out IN Form 11274?

To fill out IN Form 11274, taxpayers must provide their personal information, income details, deductions, and any relevant tax credits as per the instructions provided by the tax authorities.

What is the purpose of IN Form 11274?

The purpose of IN Form 11274 is to facilitate the correct reporting of income, ensure compliance with tax laws, and enable taxpayers to claim eligible deductions or credits.

What information must be reported on IN Form 11274?

IN Form 11274 requires reporting personal identification details, sources of income, deductions claimed, tax liabilities, and any other relevant financial information.

Fill out your IN Form 11274 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

IN Form 11274 is not the form you're looking for?Search for another form here.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.